Chelsea Financial Services has sold out of J O Hambro Capital Management’s (JOHCM) £1.3bn UK Dynamic fund after star manager Alex Savvides’ defection to Jupiter Asset Management. In a similar vein, FE Invest has decided to remove JOHCM UK Dynamic from its approved list at the next review.

JOHCM has drawn from its deep bench of UK equity managers to replace Savvides, with Mark Costar and Vishal Bhatia, who manage the smaller £168m JOHCM UK Growth fund, taking on UK Dynamic. Joining them is Tom Matthews, who was an analyst on UK Dynamic for eight years before his promotion to co-head of sustainable investments two years ago.

For investors in JOHCM UK Dynamic who are wondering whether to stick or twist, one concern is how the new team will manage a fund potentially in outflow mode.

As David Holder, senior investment research analyst at Square Mile Consulting & Research, explained: “You’ve got to maintain a diversified portfolio consistent with the established structure and style across the fund.” Given the fund has more liquid large-cap holdings and less small-cap exposure than, say JOHCM UK Growth, he does not think this will be an “impossible task”.

Some investors will sell or remove the fund by default because of the manager change. “I think that’s the nature of people aligning themselves with an experienced manager in Savvides. They buy that fund because of the approach he has established,” Holder said.

Investors should bear in mind, however, that JOHCM UK Dynamic is passing into familiar hands. “Costar is incredibly experienced and the team is relatively close knit and well established so I think that will stand them in good stead,” Holder explained. “It’s a strong cohort of investors that are pretty well bedded in. They haven’t parachuted anyone in there who doesn’t know the approach and the process very well.”

Bhatia has worked with Costar since 2007 and there is further continuity with Matthews returning to UK Dynamic, where the portfolio is approximately 90% unchanged since he worked on it, according to JOHCM.

“The portfolio hasn’t turned over substantially in the interim years so it’s still an entity that Matthews will be very familiar with,” Holder said.

The same analyst team remains to support UK Dynamic, but that throws up another element of speculation as to whether Savvides will eventually entice any of JOHCM’s analysts to follow him to Jupiter, Holder said.

There is an overlap of nine holdings between UK Dynamic and UK Growth, each of which holds around 50 stocks. “Costar recruited and trained Savvides so it’s not a massive surprise they’ve got a bit of overlap,” Holder said. “They are both looking for pockets of undervalued growth.”

FE Invest takes a different view to Square Mile on the team’s continuity. Fund analyst Tom Green said: “Savvides has a distinctive approach of investing in companies undergoing positive change or transformation. Matthews was a senior analyst under Savvides but stopped working on the fund a few years ago and Costar last worked on the strategy when he co-managed back in 2014.

“Costar and Bhatia’s main focus at JOHCM has been the UK Growth fund, which has a different approach and style to that of the more valuation-driven Dynamic fund. While we appreciate the experience that they each bring, we are concerned about the loss of the lead manager and the potential impact on the fund's performance and positioning.”

Darius McDermott, managing director of Chelsea Financial Services, said he anticipated that JOHCM would draw from its existing UK manager capability to replace Savvides, but said “with the UK Dynamic fund, it really was Savvides. We met him before he launched the fund and have been with it pretty much since then. Hence regrettably, we have sold our position.”

Five other UK value funds for investors to consider

Jason Hollands, managing director of Bestinvest, said the change of managers gives investors a chance to consider other options.

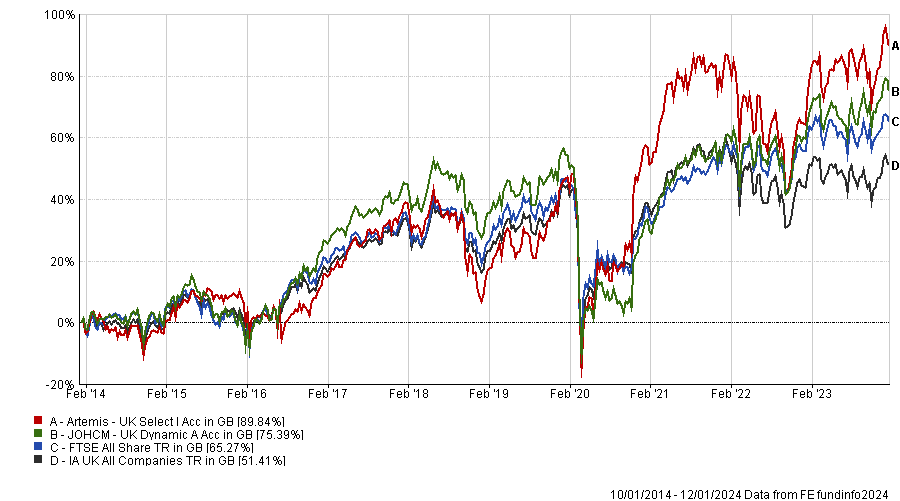

“One fund worth exploring is the Artemis UK Select fund, which has generated about twice the return of the J O Hambro UK Dynamic fund over the past 10 years and also has a slight value-style bias to it,” he said.

“Artemis UK Select is essentially a ‘best ideas’ fund, which has the flexibility to roam across the UK market-cap spectrum uninhibited by benchmark weightings, though it is typically heavily focused on companies in the FTSE 350 index of large and mid-cap stocks rather than smaller companies,” Hollands explained.

“The managers, Ed Legget and Ambrose Faulks, seek out companies with good earnings growth prospects but where they believe the current valuations are too conservative and therefore have the potential to be rerated. While the fund isn’t a dogmatic ‘value’ fund that is solely focused on cheap shares, it does have a value style bias.”

The fund has the flexibility to take selective short positions and it currently has three shorts alongside 46 long positions.

Performance of funds versus benchmark and sector over 10yrs

Source: FE Analytics

Meanwhile, Square Mile has awarded an AA rating to Man GLG Undervalued Assets and A ratings to Schroder Income, Schroder Recovery and Man GLG Income. Schroder Income and Man GLG Income are also on FE Invest’s approved list. All four funds hunt in a similar space to JOHCM UK Dynamic and Jupiter UK Special Situations (which Savvides will manage when he moves to Jupiter), so could serve as potential replacements.

Performance of funds over 10yrs

Source: FE Analytics

Schroders’ Income and Recovery funds are managed by the global value team, led by Kevin Murphy (a named manager on both funds) and Nick Kirrage.

Holder said both funds “look for out of favour companies that are underappreciated by investors but with the potential to significantly re-rate. Differences between the iterations will be determined by the bias to dividends for the Income fund, which has also historically lent this variant a slightly larger cap portfolio profile.”

The two Man GLG funds are also governed by the same investment process, approach and team, although the income fund has a bias towards dividend-paying companies.

Holder said that FE fundinfo Alpha Managers Henry Dixon and Jack Barrat, who run the funds, are “skilled at identifying cash generative, well capitalised companies where the positive prospects are not reflected in the price”.