Only one week into 2024, it has already been a cold shower for investors, many of whom have been left wondering what is happening in markets right now, with the S&P 500 declining 1.5%, the Nasdaq 3.1% and the FTSE 100 losing 0.6%.

Experts have been saying that a recession is inevitable – so for investors who want to be prepared, Chelsea Financial Services managing director Darius McDermott has put together a portfolio focused on income to play markets defensively.

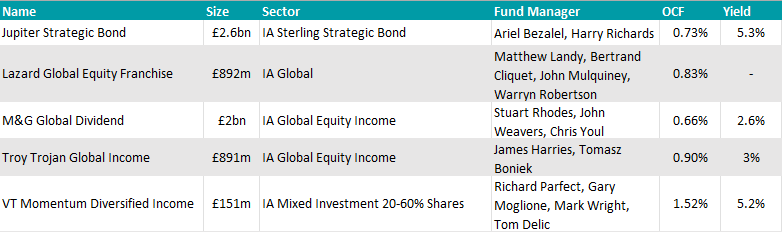

He suggested five vehicles – two global income funds, a bond portfolio, an alternative strategy and a global growth fund.

The portfolio should work well for new retirees too, with their income requirements dictating the appropriate split of income and growth elements in the portfolio. They should consider how much yield is required today versus dividend growth for income in the future and out-and-out growth to make sure the pot of money lasts. The percentage allocations indicated below are ballpark figures for “medium” income.

We begin with global income and the M&G Global Dividend and Trojan Global Income funds, which together “could be a good balance”.

Both give “moderate income” but also dividend growth for the future and some capital growth, so McDermott’s adjustable allocation is 15% each.

The M&G fund invests in companies with stable and rising dividends of three types – quality, disciplined firms with reliable growth, cyclical companies with a strong asset base, and those experiencing rapid growth from either a product or geographical area.

It appears in three best-buy lists out of the five that are published by the main investment platforms, convincing analysts at Fidelity, interactive investor and Hargreaves Lansdown.

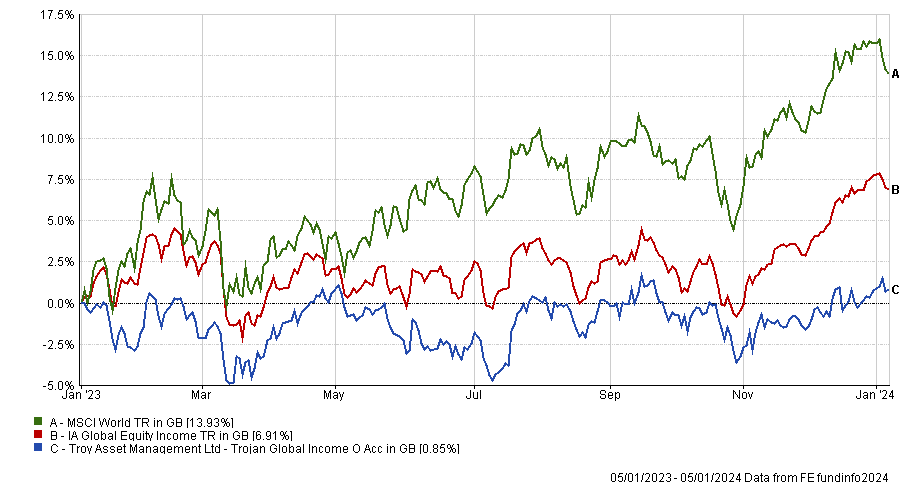

Performance of fund vs sector and index over 1yr

Source: FE Analytics

“The three distinct categories mean the stocks have different risk drivers, which in turn means that the fund can cope with different market conditions,” he said.

The Trojan fund aims to provide an “attractive and regular” stream of income which grows in real terms, to minimise the risk of permanent capital loss, and to allow capital to compound through long holding periods.

Performance of fund vs sector and index over 1yr

Source: FE Analytics

“The manager has a very clear idea about the sort of businesses he likes and those he doesn’t. The fund has a consistent bias to quality and businesses with low capital intensity and low cyclicality are much more likely to make it into the portfolio,” he said.

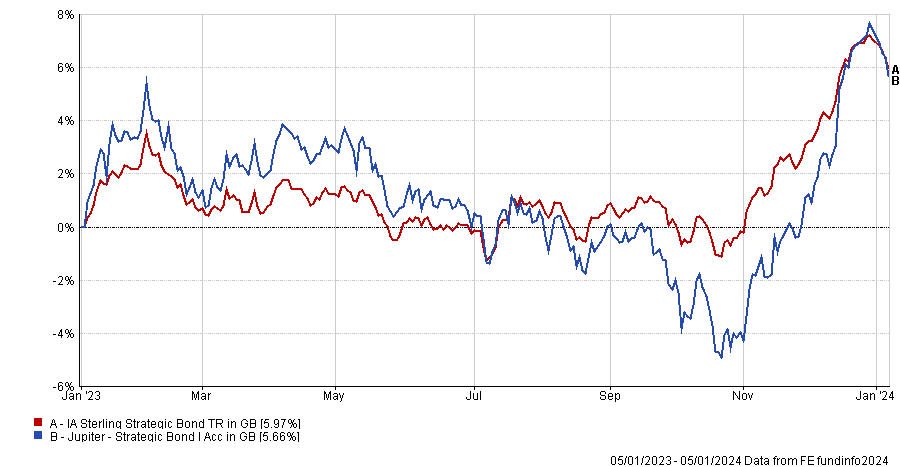

For the fixed income allocation, McDermott chose Jupiter Strategic Bond, which he described as a “flexible 'go-anywhere' fund” that allows the manager “considerable freedom” to exploit opportunities across global bond markets.

Performance of fund vs sector and index over 1yr

Source: FE Analytics

“The manager, Ariel Bezalel, is quite cautious in his approach and emphasises limiting potential losses in tough markets. He and his team conduct their own macroeconomic research, analysing global monetary policy and data relating to economic activity,” said McDermott.

“Once they have formulated their views, they will then decide in which bonds to invest. The team can also use derivatives to take short positions to profit from falling bond prices.” The fund currently yields 5.3%.

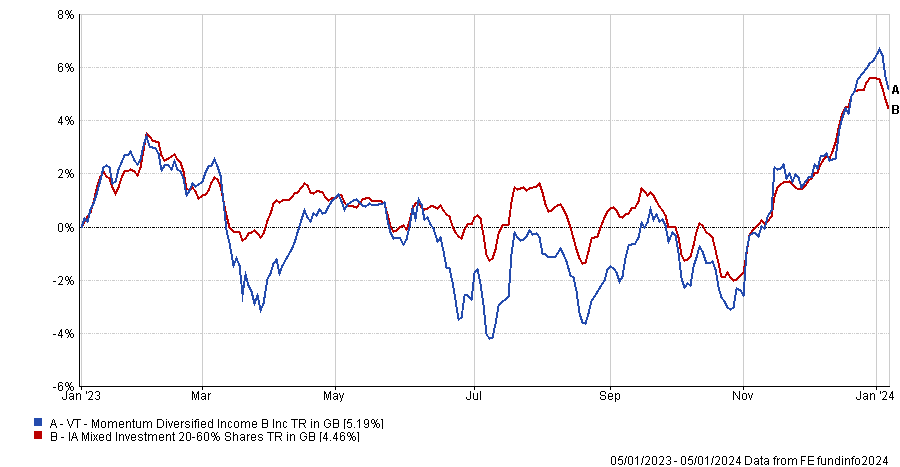

With a 5.1% yield, VT Momentum Diversified Income was selected for its value-focused style and its invest remit across all asset classes – including UK and overseas equities, fixed income, property and specialist investments held through third-party funds.

Performance of fund vs sector and index over 1yr

Source: FE Analytics

“Save for the regulatory requirements, this is a go-anywhere portfolio without any constraints. The value style tends to result in the managers buying out-of-favour investments and they then have to bide their time in order for the investment to pay off,” said McDermott, who added: “This could be quite a lengthy process, but hopefully a rewarding one.”

Jupiter Strategic Bond fund and Momentum Diversified Income both yield more than 5%, so investors could have 20% in each of these.

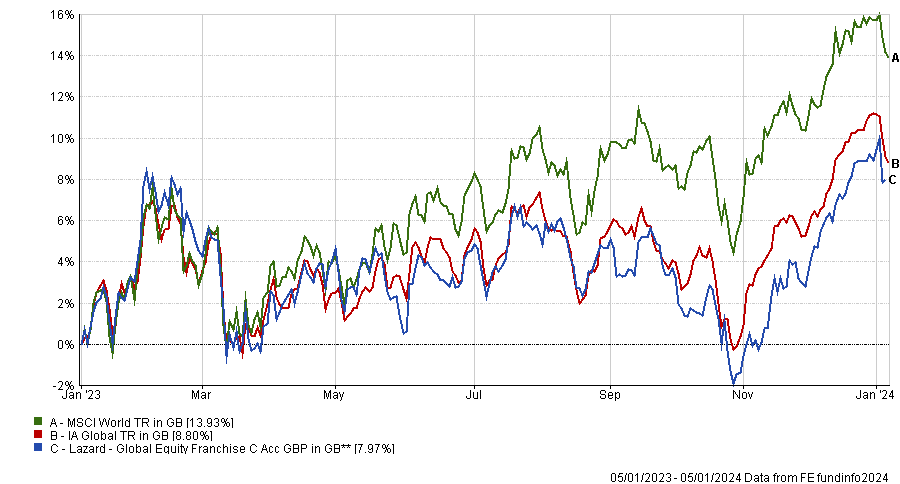

Finally, Lazard Global Equity Franchise completes the mix, a “solid” global fund to provide capital growth for future income, where McDermott would hold circa 30%.

Performance of fund vs sector and index over 1yr

Source: FE Analytics

It has no style bias, is concentrated in 30 portfolio holdings only and “looks very different to the majority of its peers”.

“It simply looks for solid industry leaders with natural monopolies, cost leadership, strong brands, intellectual property or high barriers to competition,” which convinced McDermott.

Source: FE Analytics