UK investors still have a home bias towards the domestic market – something that could be the right call, according to market commentators.

Research from Quilter in 2021 found that 64% of people with £60,000 in investible assets had more than a quarter of their portfolio in their home market, while 8% had the entirety of their investments in the UK.

That might come as a surprise as the UK has decreased in relevance on the global stage, representing just slightly more than 4% of the MSCI World index today, with the first UK stock (AstraZeneca) in terms of weighting coming in 29th place.

On the top of that, the UK market has been criticised for its shortcomings in certain areas.

For instance, Nick Train, manager of the Finsbury Growth & Income Trust, recently pointed at the absence of significant tech champions in the UK market.

Tech is not the only sector in which the UK stock market is lacking.

Rob Burgeman, investment manager at RBC Brewin Dolphin, said: “This is not to pooh-pooh the UK market, but there are many globally important sectors where the UK has little exposure of significance.

“Luxury goods, for example, is the forte of Paris. It is hard to compare LVMH and its stable of brands with the iconic check of Burberry – a brand, certainly, but nowhere near the scale of the French giant. Beauty products, too, have naturally driven investors to L’Oréal in Paris or Estee Lauder in the US, not to mention Shiseido in Japan.”

Yet, there are other sectors where the UK market can boast top billing. That includes, for example, miners, with three of the five biggest firms in this sector (Anglo American, Rio Tinto and Glencore) listed in London.

Burgeman added: “In the world of alcoholic beverages, Diageo is going to merit a place in any global investor’s portfolio, as are the oil giants BP and Shell.

“Pharmaceuticals are well represented with Glaxo SmithKline and AstraZeneca as are media agencies (WPP), global banks (HSBC) and consumer goods (Unilever).”

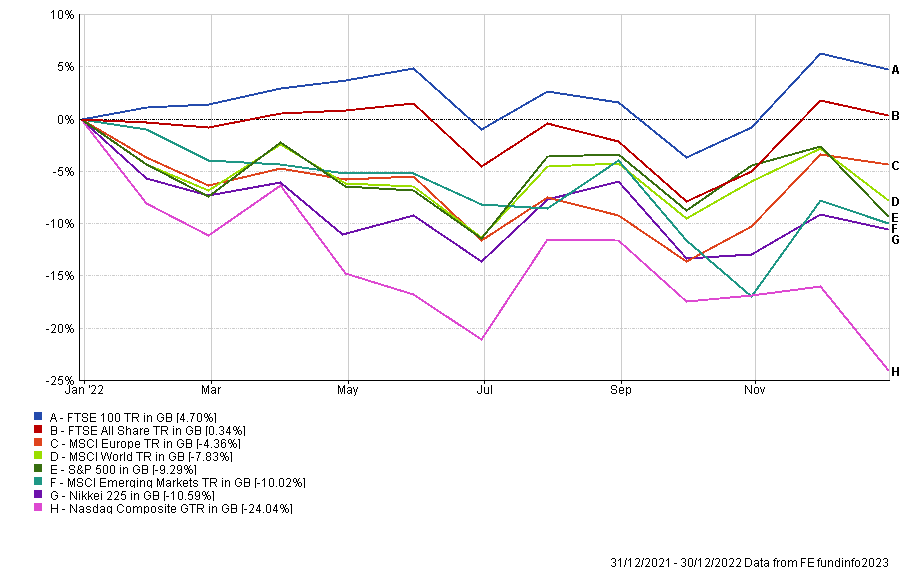

Performance of indices in calendar year 2022

Source: FE Analytics

As a result of the strong presence of miners and oil giants, the UK provides genuine diversification versus overseas markets.

Shanti Kelemen, chief investment officer at M&G Wealth, said: “The sector composition of the UK equity market is very different from global equities, as energy, basic materials, financials and consumer staples account for more than half of the FTSE All Share Index.

“That diversification is valuable, as we saw in 2022 when UK equities were one of the better performing equity regions.”

In addition, the UK market is relatively cheap compared to the rest of the developed world, with several stocks trading at a discount.

M&G Wealth found through its investment process that having UK equities enables to build better portfolios.

The firm currently has a quarter of the equity allocation in its passive and hybrid model portfolios in UK equities.

Kelemen said: “We make decisions about whether to include asset classes in portfolios based on their expected returns, volatility and correlations with other investments. Through those lenses, UK equities bring clear benefits to the overall risk profile of a portfolio.”

David Henry, investment manager at Quilter Cheviot, said: “There are businesses listed in London that are genuinely global in nature and trade at sizeable discounts to very similar peers listed on overseas markets.

“It is hard to escape the conclusion that in the process of the UK’s reducing relevance in terms of global markets, some babies may have been thrown out with the bathwater.”

Therefore, experts said including a specific exposure to the UK market improves a portfolio’s resilience.

Henry suggested that it would be “sensible” for a balanced investor to have a third of their equity exposure in domestic UK stocks.

Burgeman added that UK-domiciled investors should have 20% to 25% of their equity exposure to the UK, while global investors should have 10% to 15%.

However not all were convinced. Kamal Warraich, head of equity fund research at Canaccord Genuity Wealth Management, said it is not essential to have a home market allocation and that it would depend on a variety of factors, such as the portfolio’s benchmark, the required yield and the type of strategy.

He added: “The UK is typically seen as a play on large-cap value and has one of the highest yields globally. So during periods where value is in favour (typically when inflation is rising), then it may make sense to run an overweight to the UK.”