The so-called Magnificent Seven overshadowed the rest of the stock market in 2023 thanks to the enthusiasm around artificial intelligence.

Yet, those seven companies – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla – now trade on very high valuations, suggesting a lot of their future growth is already priced in. As a result, Simon Skinner, head of the global investment team at Orbis Investments, warned that the Magnificent Seven might not live up to the expectations put in them.

“They are excellent businesses with strong prospects. That's why they have been such good performers and why the narrative around them is universally positive. It is so well recognised that their prospects are good, [but] those investment propositions at that point might not be that attractive,” he said.

“The valuations attributed to the Magnificent Seven are quite high, so if their fundamentals should be anything less than fantastic, they might not turn out to be the investment proposition a lot of people are hoping.”

As a result, Skinner stressed that there might be an opportunity cost in focusing on those seven stocks and ignoring potentially more attractive options in what he calls the “Magnificent Middle”, or companies with a market capitalisation ranging from $2bn to $20bn and trading on lower valuations.

While such businesses would fall in the mid-cap category in the US, they would be considered large-caps in the UK.

Financials

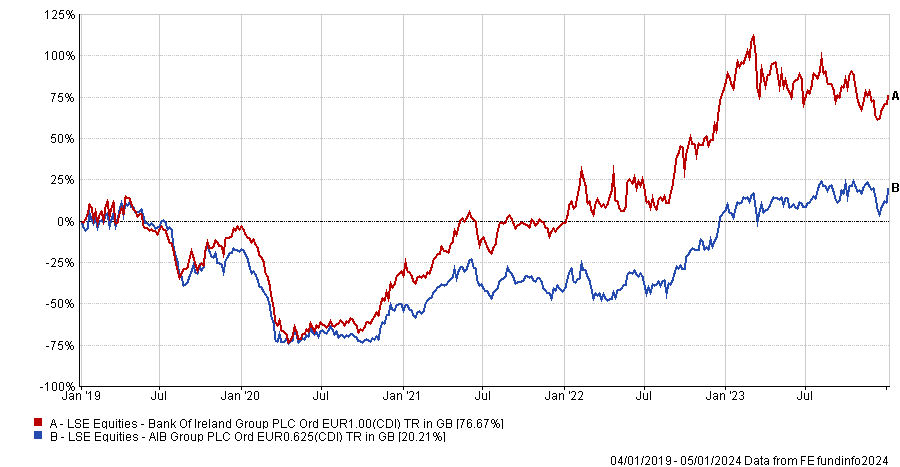

Among those mid-cap stocks, Skinner highlighted opportunities in the financials sector and more particularly Irish banks such as AIB and Bank of Ireland.

The global financial crisis was very severe in Ireland and has taken more than a decade to unwind, with the banking and housing markets being particularly impacted.

Skinner said: “What we're left with is a banking market that is extremely consolidated. We’ve gone from nine competitors down to three today, with two of them being quite dominant.

“The economy is in much better shape than it was 10 years ago. Consumers and corporates have de-levered and the financial regulation around lending is now much tighter. It's unlikely that people will get themselves into trouble with property the way they have in the past.”

The important thing is that this improved outlook is not implied in the valuations of AIB and Bank of Ireland, which are both trading below book value.

“They are likely to deliver a 15% return on equity next year. They both have excess capital, so it's very likely that most of their earnings will be returned to shareholders via a combination of share buybacks and dividends. Total shareholder return could be well over 10%,” Skinner added.

Performance of stocks over 5yrs

Source: FE Analytics

Other financial companies that Orbis Investments finds attractive for their outsized local influence include Shinhan Financial, Samsung Fire & Marine Insurance and Hana Financial in South Korea as well as Hong Kong-based Jardine Matheson.

Defence

Orbis started to look at the defence sector three years ago, when it was out of favour for being on the wrong side of ESG (environmental, social and governance) trends. Yet, the conflict between Russia and Ukraine has changed investors’ perception on this industry.

Skinner explained: “We thought that if there were to be more conflicts in the world than there used to be previously, demand would rise and these companies would do well. They would come back from the darkness and that's exactly what happened.

“Defence companies are not going away. You can object to the products they sell, but if you think about what they enable to prevent, they are actually constructive and necessary for society. They are parts of the solution for national security rather than problems.”

He highlighted Italian defence group Leonardo, which has been unpopular for a long time because it used to be “badly run” with poor cash generation. Moreover, the firm delivered the low end of its revenue targets.

Yet, there have been significant changes in the management of the firm with the appointments of a new chief executive officer and a new chairman, among others, in 2023.

The new CEO has already indicated that the business is aiming to take a more constructive approach to cost discipline and has been selling off or closing unprofitable businesses.

The company has also been paying down debt and its credit rating has been upgraded to investment grade. In addition, Leonardo is looking to increase shareholder returns with the cash the company is generating.

Skinner said: “Leonardo is a company that has long been out of favour for good reasons, but has made constructive governance changes and is now facing an improved demand environment.

“You can see how Leonardo will look much more like a conventional defence business in three or four years’ time. Yet today, it's still one of the cheapest defence businesses globally and no one's paying attention.”

Performance of stocks over 5yrs

Source: Google Finance

He also pointed to other attractive European defence companies such as Saab in Sweden and Rheinmetall in Germany.

Offshore oil drillers

The oil industry also fell out of favour due to the ESG trends, as oil was perceived to be in structural decline and, therefore, not investable anymore.

Yet, Orbis Investments disagrees with this view and believes that oil, especially offshore oil, will still be needed for a long time.

“Offshore oil tends to be low cost when it is in production and there are some big reserves accessible only offshore,” Skinner said. “That underpins our confidence that oil rigs will be in demand for a material portion of the next 30 to 50 years.”

Moreover, drops in energy prices in 2014 and 2020 mean a lot of oil drillers faced bankruptcy or went out of business. As a result, surviving companies reemerged into public markets with better balance sheets.

Skinner added: “Nobody has ordered an oil rig for an awfully long time. Therefore, if we look into the future, we can see a situation where you have companies with relatively good balance sheets and good assets, which are now in demand from large oil companies and national oil companies. Yet, their order books are effectively empty.

“As their assets depreciate and eventually come out of service, there will be a shrinking pool of supply, but a steady demand. If you think about what that implies for the returns oil rig companies should be able to generate on their asset basis, that's quite constructive. They should be able to produce good cash returns.”

Performance of stocks over 5yrs

Source: Google Finance

Among the offshore oil drillers, Orbis owns Noble, Valaris, Transocean and Borr Drilling, which have a combined market capitalisation of less than $20bn— about a tenth the size of Shell.