Active management had the upper hand in 22 Investment Association (IA) sectors out of 54 in 2023, data from FinXL shows.

For this research, Trustnet looked at the performance of active funds in each IA sector to establish how many managed to beat the market by measuring their performance against the most common benchmark in the corresponding peer groups.

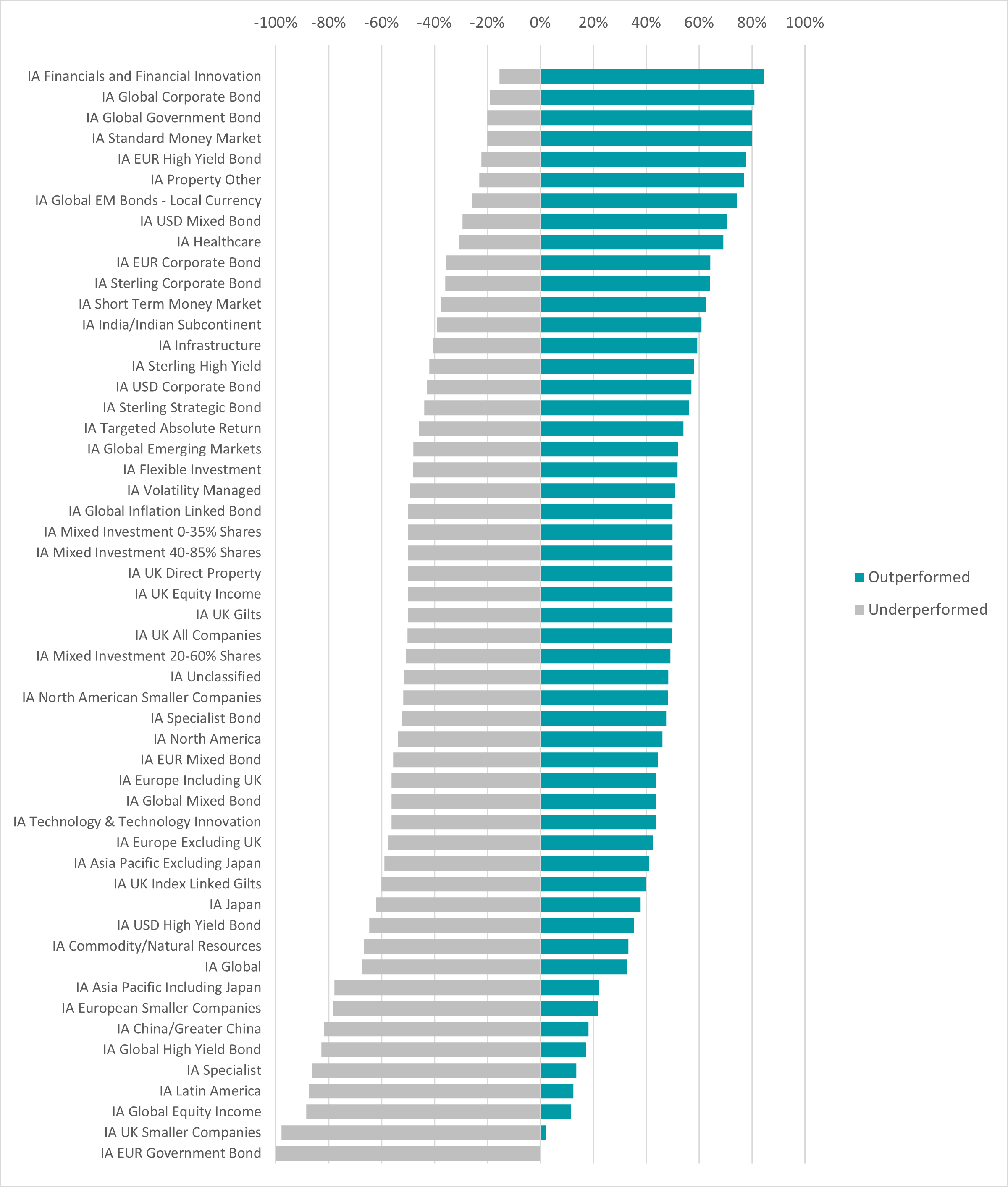

Below, we reveal in which sectors investors should have preferred actively managed portfolios (on the upper side of the chart below) and where they might as well have gone for a cheaper, passive alternative (on the lower side of the diagram) to get the most from their money.

Performance of active funds against the most common benchmark in the sector in 2023

Source: FinXL

First up is the IA Financials and Financial Innovation sector, where 84.6% of active funds managed to beat the MSCI ACWI/Financials index. Of the 12 funds that did, 11 were actively managed.

Making the highest returns here were T. Rowe Price Future of Finance Equity, Robeco FinTech, Wellington FinTech Fund, AXA Framlington Fintech and Jupiter Global Financial Innovation, all of which have a high allocation to technology companies, which have rallied in 2023 and propped them up.

Active funds worked well in many fixed income sectors too, with the data possibly confirming the market’s preference for active management when buying debt. Passives are more exposed to the largest index constituents by nature, which in this space tend to be the most indebted and riskier companies.

In the IA Global Corporate Bond, the top funds were Pimco GIS Global Investment Grade Credit Fund, AXA World Funds Global Buy and Maintain Credit and Vanguard Global Credit Bond, which returned more than 8% versus the 2.9% of the Bloomberg Global Aggregate - Corporate Hedged USD index.

However, the passive Vanguard Global Corporate Bond UCITS ETF almost matched their performance, together with its environmental, sustainability and governance (ESG) sibling version.

Alternative and thematic investments such as property, healthcare and infrastructure also seem to have worked better with a person at their helm.

The actively managed abrdn European Real Estate Share made 18.6% last year, following from its European counterpart ranking among the best-performing funds in spring last year. The best among the passives, SPDR FTSE EPRA Europe ex UK Real Estate UCITS ETF, fell short at 15.9%. This sector had 19 outperformers, 14 of which were active.

In the IA Healthcare sector, where the average return was -2.2%, all funds that made money instead of losing it were actively managed. Polar Capital Healthcare Opportunities stood out with a 4.4% return, albeit being less frequently talked about than its other version, the Polar Capital Global Healthcare Trust.

It was a coin toss for many of the most popular sectors, including IA Flexible Investment, IA UK Equity Income, IA UK All Companies and IA North America, where the chance of active portfolios outperforming passives was approximately 50%.

In these sectors, VT Tyndall Unconstrained UK Income has been profiting from underpriced UK stocks at “amazing valuation”, as manager Simon Murphy told Trustnet last year, Ninety One UK Special Situations was among a handful of value strategies that were topping the charts at the beginning of last year and AB American Growth Portfolio was among the few funds to have beaten the S&P 500 since the financial crisis. These three vehicles were all well above the second-best performer in their sectors.

Turning to the lower side of the chart, where investors should have favoured passive vehicles, the main standout is the IA Technology and Technology Innovation sector.

Here, the returns were driven by the biggest companies in 2023, which are held by all index funds, so passives did better. Here, not owning the winners could have massively penalised managers and active selection could have been detrimental.

Liontrust Global Technology has done a good job of this – it was ranked among the funds that you should have owned in the first half of 2023 and made 58.8% over the course of the year, beating the WisdomTree Cybersecurity UCITS ETF by a narrow 1.8 percentage points.

In the IA Japan sector, 45 funds outperformed the 12.8% of the TSE TOPIX index, 25 of which were actively managed. The top performer, Nomura Japan Strategic Value, more than doubled the best-performing passive, Amundi MSCI Japan, at 40.1% against the latter’s 28.5%. However, investors had a better chance of making more money by picking a passive than an active fund.

The performance divide was less stark in the IA Global sector, where the active abrdn World Equity Enhanced Index fund made 19.9%, achieving a smaller distance from the Amundi Index MSCI World’s 16.8%.

But here the chances of picking an outperforming active fund were slim – of the 343 funds that failed to beat the benchmark (the MSCI ACWI index), 289 (84%) were actively managed.