The FTSE 100 may have barely budged in 2023, lagging behind most major global markets, but AJ Bell investment director Russ Mould believes 2024 could be a different story.

Despite the prevailing gloom, Mould argued that the FTSE 100 could reach new highs next year, driven by a combination of attractive valuations, robust dividend payouts and potential upside to earnings forecasts.

Mould said: "After a gain of barely 3% in 2023, the FTSE 100 is no higher now than in early 2018, when Theresa May was prime minister and still trying to make the best of Brexit.

“But dividends, share buybacks and takeovers mean this year is not a total bust, even if investors will feel disappointed by the lack of overall capital returns.”

Index capital return in 2023

Source: LSEG Datastream data

Even with a general election looming, sticky inflation and low expectations for UK GDP growth Mould said “it is possible to make the case for the UK's premier stock market benchmark setting new peaks in 2024”.

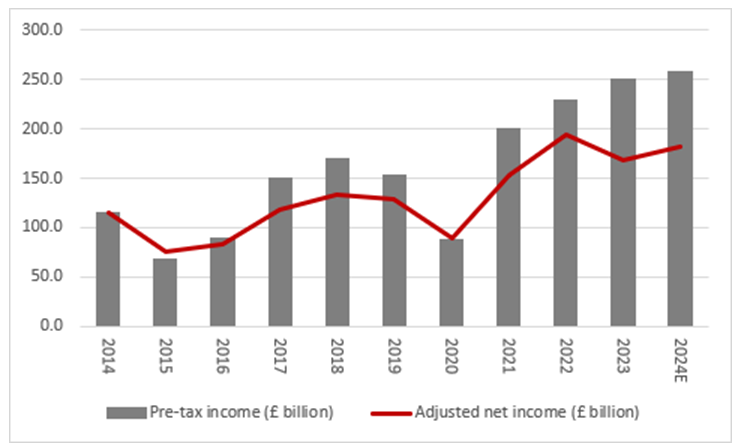

He pointed to analysts' expectations for a 52% increase in aggregate pre-tax income in 2024 compared to 2018 and a 36% jump in adjusted net, post-tax earnings.

Pre-tax income vs adjusted net income over 10yrs

Source: Marketscreener

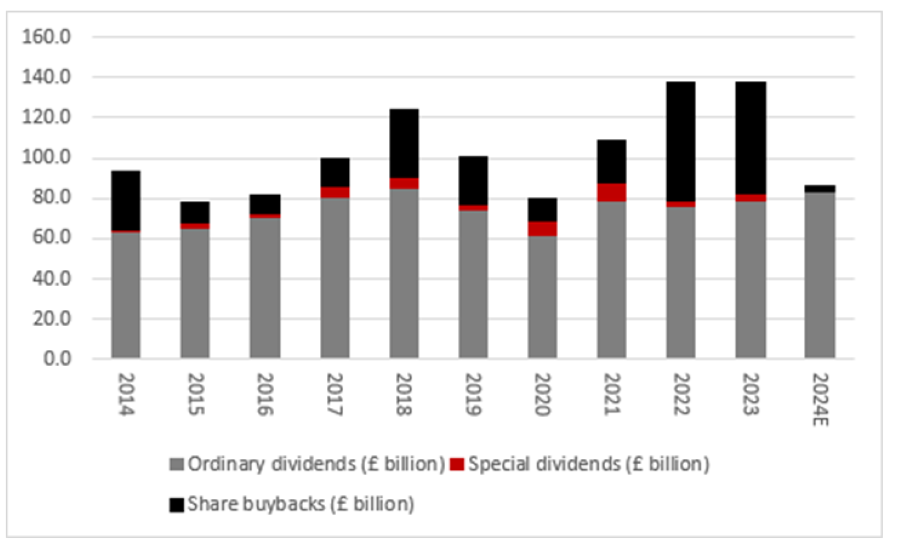

Furthermore, Mould emphasises the FTSE 100's generous income stream, with a forecast cash yield of 6.7% for 2023, thanks to a record £54.7bn in share buybacks and £78.7bn in anticipated dividend payments.

Ordinary dividends vs special dividends and share buy backs over 10yrs

Source: Marketscreener

Mould added: “Even if there is no guarantee of a repeat in 2024, dividend cover is nicely above 2x based on consensus analysts' forecasts for earnings and dividends, and forecasts of a 4.2% dividend yield combined with a forward price-to-earnings ratio of barely 11x may catch the eye of value-seekers.”

With the Bank of England expected to cut rates four times next year, lower borrowing costs could also boost corporate profits and valuations.

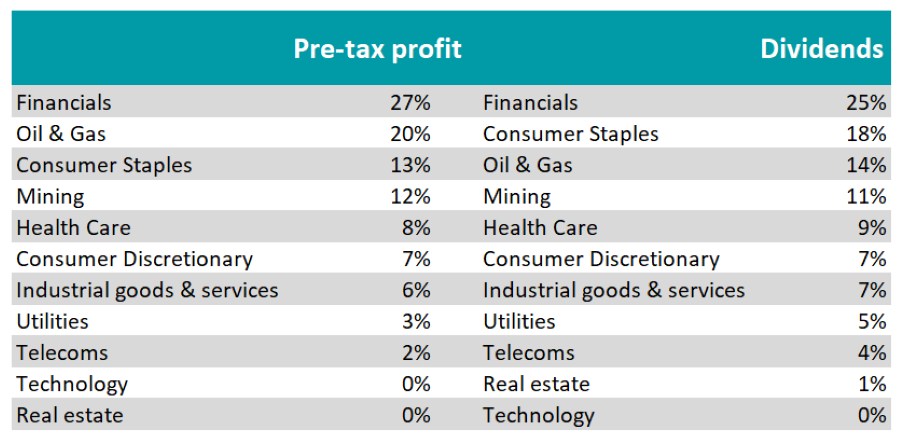

Percentage by sector for total FTSE 100, 2024E consensus forecasts

Source: Marketscreener

The index's heavy weighting towards commodities-linked sectors such as oil & gas and miners could benefit from an inflationary or stagflationary environment, potentially leading to upward revisions to earnings estimates.

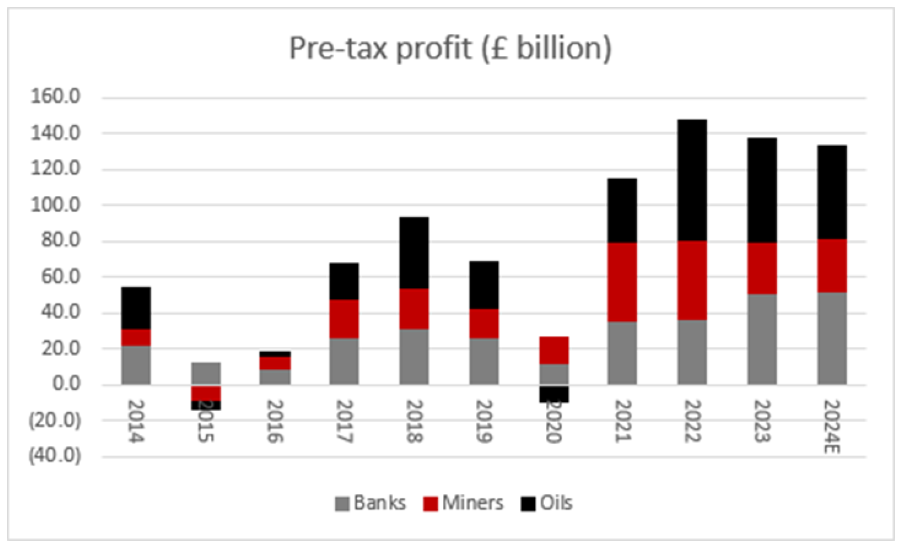

Banks vs minors and oils over the past 10yrs

Source: Marketscreener

Another feather in the UK cap is cheap valuations. Compared to markets such as the US, with its tech-heavy focus, the FTSE 100's more traditional composition offers lower valuations and potentially less downside risk.

While Mould painted a bullish picture, he acknowledged the uncertainties that could derail the rally including geopolitical tensions, persistent inflation, and a potential recession.

Mould added: "Markets continue to put their faith in central banks and their ability to rein in inflation, engineer a soft landing for the global economy and maintain financial market stability. But there are inherent dangers in relying on the very same people who promised inflation would be transitory."