Geopolitical risk is becoming an increasingly important factor to consider when investing as tensions have been on the rise in recent years.

But on the domestic front, changes to the political landscape could also be afoot. Below Trustnet looks at how politics could shape the UK market in the next few years.

Geopolitics

For wealth managers, the rivalry between China and the US poses the biggest geopolitical risk to global markets followed by the ongoing wars in Eastern Europe and the Middle East as well as the deglobalisation trends.

Those negative dynamics also impact the UK market as many of the largest companies in the country are outward-looking and therefore predominantly affected by global market conditions.

Henrietta Walker, head of investment specialist team at Brooks Macdonald, said: “Around three quarters of the aggregate revenues of the UK equity market index are derived from outside the UK.

“As such, the UK stock market is particularly sensitive to global trends, be they higher oil prices, exposure to a still-resilient US consumer-led economy or a continuing, albeit slower than-hoped-for, China economic growth recovery picture so far this year.”

David Cadwallader, investment manager at RBC Brewin Dolphin, highlighted the risk posed by oil price shocks as they are considered to have been a significant cause of recessions in the 1970s and 1990s.

He said: “Rising prices cause consumers to cut back on discretionary spending and can exacerbate inflationary pressures. Essentially a spike in the oil price can drag on growth in the medium term, but in the shorter term it's inflationary and could lead to further rises in interest rates.

“Pressure on economic growth, coupled with a second inflationary spike, could have significant implications for both bonds and equities.”

The UK political landscape

On the top of those global risks, UK assets are also exposed to domestic risks. Although the UK has historically been relatively stable from a political/geopolitical point of view, this has been less true in recent years.

Tom Hopkins, portfolio manager at BRI Wealth Management, said: “The events of the mini-Budget last September were a stark reminder that the UK isn’t immune to politically led volatility.

“The UK has struggled for popularity on the world stage for many years and any negative political news tends to further knock back the confidence of international investors in UK publicly listed companies.”

Prior to the mini-Budget in 2022, a major UK-specific upheaval had been Brexit. Although it has now been finalised, Charles-Henry Monchau, chief investment officer at Syz Group, stressed that the long-term implications are still unfolding.

“The UK's trade relationships, regulatory alignment with the EU, and stance on immigration are areas that could see further evolution based on the political leadership,” he said.

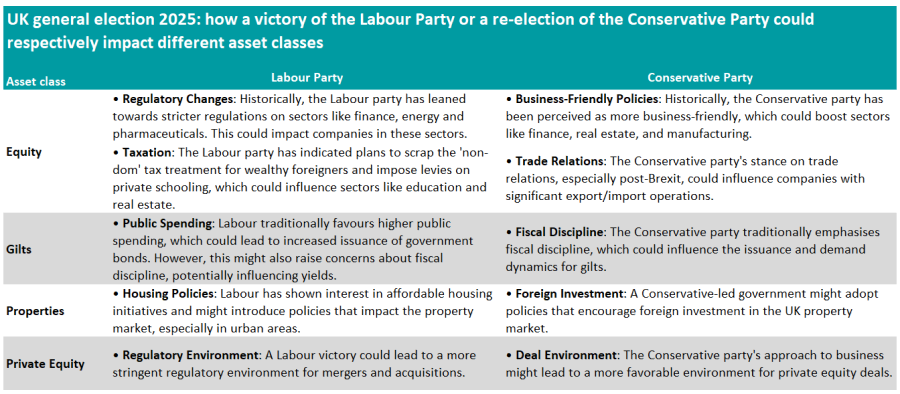

Another UK-specific risk could emerge from the next general election, which is due to take place before the end of January 2025 at the latest.

Potential scenarios are still hard to predict at this point in time but uncertainty could lead to short-term market volatility as we get closer to the election period, with investors trying to anticipate potential policy changes.

On the long term, the outcome of the election will be crucial to shape the perception of the UK as an investment destination.

Monchau said: “A government perceived as stable, predictable and business-friendly could attract foreign investments, boosting markets and assets.

“From an investor's perspective, the ideal outcome would be a clear majority for any party, ensuring political stability and a predictable policy environment.”

Yet, whatever party comes into power, a range of difficulties is awaiting the next government.

”Lower economic growth, lower productivity, strained trading relationships, stretched public services, weak finances and high indebtedness means any new government will not be able to borrow its way out of these issues, leaving a tough trajectory for any party,” Hopkins said.

Source: Syz Group

Overall

Nonetheless, both BRI Wealth Management and Brooks Macdonald are positive on the UK market.

For instance BRI Wealth Management’s Hopkins stressed the resilience of the UK economy, with good quality companies trading at bargain prices in comparison to international peers.

He said: “The FTSE All-Share index is currently trading at approximately 10.2x forward [price-to-earnings] P/E, much lower than the 13.9x historical average.

“In addition to this, areas of the investment trust market are trading on the widest discounts since the financial crisis, making the UK market an attractive proposition. M&A activity will continue if we don’t see these discounts narrow.”

Brooks Macdonald’s Walker added that the domestic picture is not the only driver for the UK equity market investment case, stressing that the UK economy and equity market are not the same.