There are ways to make a good return on European equities, but it is not an attractive market to invest, according to Alexander Darwall, manager of the European Opportunities Trust.

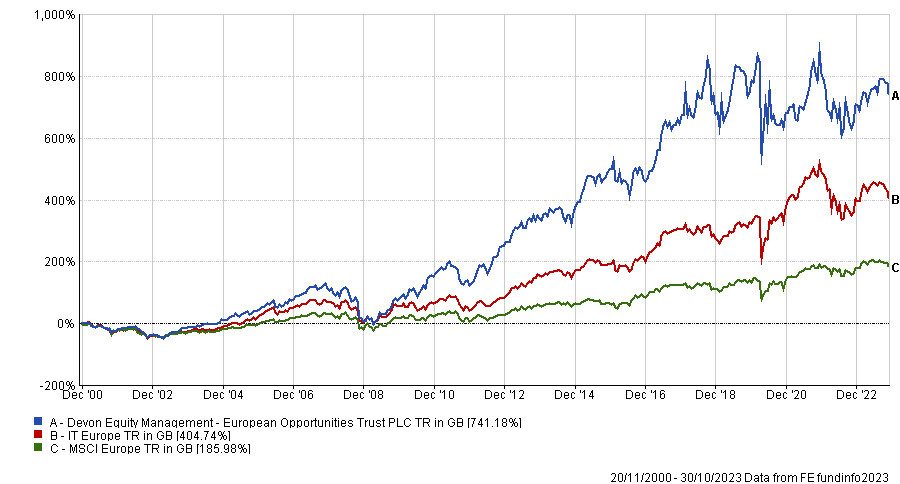

He made a 741.2% return that was almost four times greater than the MSCI Europe benchmark since launching the fund in 2000, yet good stocks have been few and far between.

“I see Europe as having some great expertise, but I'm much less excited about the European economy,” Darwall said. “I'd never make a case for this fund on the back of the European economy.”

Total return of trust vs sector and benchmark since launch

Source: FE Analytics

He noted the underperformance of European equities relative to other stock markets around the world, particularly the US, which has led to a lack of sentiment towards the region – one that is likely to deepen further if the continent falls into recession next year, as Darwall anticipates.

Over the long term, Europe is also faced with headwinds from net-zero plans – something many investors are excited about, but Darwall sees as another drag on the already struggling market.

“I think the energy transition presents a challenge to Europe,” he explained. “It’s presented as a change to the disappointing direction of underperformance in European economies over the past 15 to 20 years.

“In my view, it is unlikely to be helped by the energy transition – it is probably going to be hindered by it.”

Total return of indices over the past 10 years

Source: FE Analytics

Despite Darwall’s pessimistic forecast for the European market as a whole, he did say there are glimmers of hope on a stock-by-stock basis.

There are a number of companies Darwall has upped exposure to, such as pharmaceuticals businesses Novo Nordisk and Grifols, that have resilient revenues from around the globe that should protect them from volatility in their domestic markets.

“We're more focused on the type of company we have,” he said. “We want companies where there is a low correlation with domestic economic performance.

“Even when the economy is in slowdown, there are some companies that are doing great because they have innovation or products that are doing very well, so we're much more micro than macro-focused.”

Share price of Novo Nordisk and Grefols over the past year

Source: Google Finance

However, Darwall warned that the finite number of successful companies in Europe are being tempted away from their troubled domestic market to more enterprising economies such as the US

“I would make the case for there being some world-leading companies based in Europe, but it's not surprising that companies such as Novo Nordisk, Experian, Genus and Relex do far better in America, where their innovation is much more welcomed,” he said.

“I can't make the case for Europe, but look at those great European companies that are thriving elsewhere because it's more comfortable for them in America than it is here.”

Indeed, years of “disappointing” results made European equities undervalued and allowed private equity buyers in the US to swoop in and acquire leading companies at bargain prices.

In the past few months alone, three of Darwall’s small-cap holdings – payments processor Brookfield International, satellite manufacturer OHB and open source software provider Suse – have been purchased by North American firms at prices well below their true value.

“One of my concerns is that there’s so much apathy and lack of interest in investment in Europe at the moment,” he said. “That’s a real problem because we've seen huge outflows over the past year and private equity is getting some bargains, which is not good for public investors.”

Undervalued assets may have put Europe in the sights of US private equity firms, but it also creates some appealing buying opportunity for investors who know where to look.

Though the number of strong European companies are limited, they present a good entry point for investors wanting world-leading companies at low valuations, according to Darwall.

“How do I make the case for Europe? I really don’t know, but I do think there is some really good value to be found because there’s been increasingly more focus on mega-caps,” he added.

“Global allocators are probably allocating – if they're allocating to Europe at all – to the likes of LVMH Novo Nordisk and ASML, but there’s an awful lot of good value below that which is being ignored. I would much rather that public investors own them than just handing them over to private equity too cheaply.”