US equities have rewarded investors richly, with the S&P 500 index the best performing major stock market over the past decade. The flipside however is that some stocks are now trading on high valuations.

As such, some asset allocators believe that now may be a good time to trim positions in the US and look for greener pastures.

Yet, for Fiona Harris, US equities investment specialist at JPMorgan Asset Management, those high valuations are justified and a non-issue due to the quality of the companies available across the pond.

She said: “If you're comparing the US to other markets, it's always going to be more expensive. You're always going to find a cheaper market somewhere.

“But if you're only concerned about the price you're paying, be careful. Valuation doesn't tell you anything about the quality of what you're buying. All it tells you is the price you're paying.”

Harris took the example of Nvidia, which was trading on a price-to-earnings ratio (P/E) of just below 60x at the beginning of the year but rallied 174% year-to-date.

She said: “It’s a perfect example of a stock that you might have shunned at the beginning of the year because of its valuation. Yet, the stock has rallied because it has delivered better earnings and trades now on a 30x forward P/E.”

While Harris does not downplay the importance of valuation, she believes that factors such as earnings, cash flows and management teams are as, if not more, important.

Moreover, US companies – as well as the US economy – have proven to be resilient. Despite high interest rates, companies are still hiring, consumers are still spending and the S&P 500 is up 8.3% year-to-date, while a recession has been avoided so far.

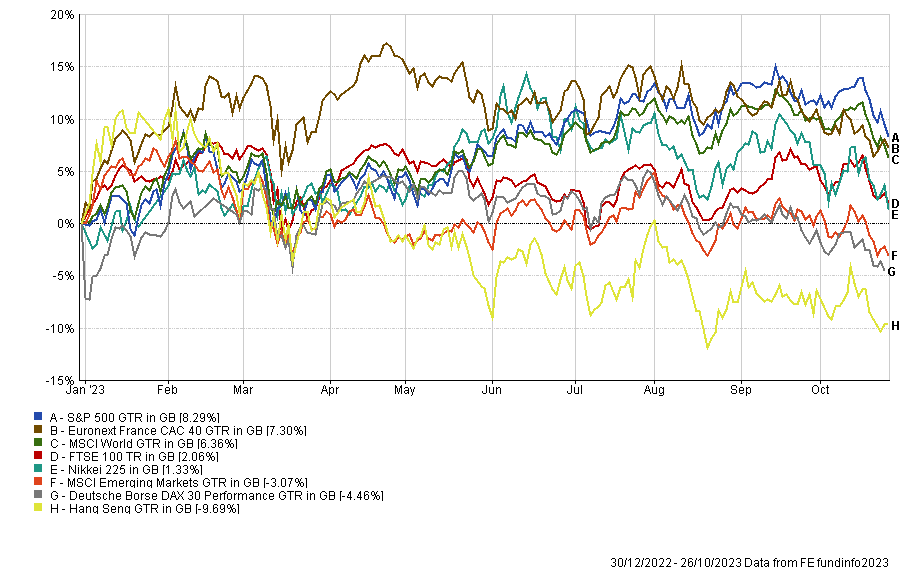

Performance of indices YTD

Source: FE Analytics

Harris said: “When we're talking to companies, they're doing fine. A lot of them are saying: ‘we're not letting our workers go, we only got to full employment six months ago and it cost us so much time to find qualified people and so much in wages to get these people. We're not turning the dime in the other direction, because we know how hard it is to find great people’.

“At some stage, we will have a recession, but we don't know when. All we can do is talk to the companies, see what they're doing and how they're feeling. But until this positive narrative changes, it's very hard to see how we could have a major recession.”

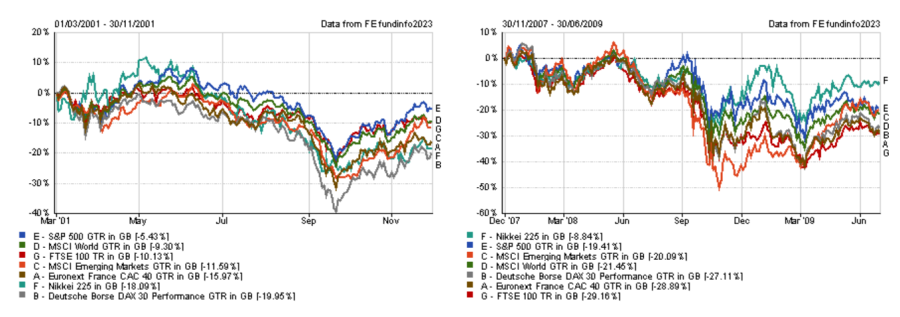

Nonetheless, Harris is not too worried about a recession, including a US-led one, as US equities tend to outperform other markets in recessions. She explained it is because US businesses tend to be higher quality.

Performance of indices during the early 2000s recession and the Great Recession

Source: FE Analytics

Another criticism levied at the US is that the market has been mostly led by a handful of stocks, now known as “The Magnificent Seven” (Alphabet, Amazon Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla).

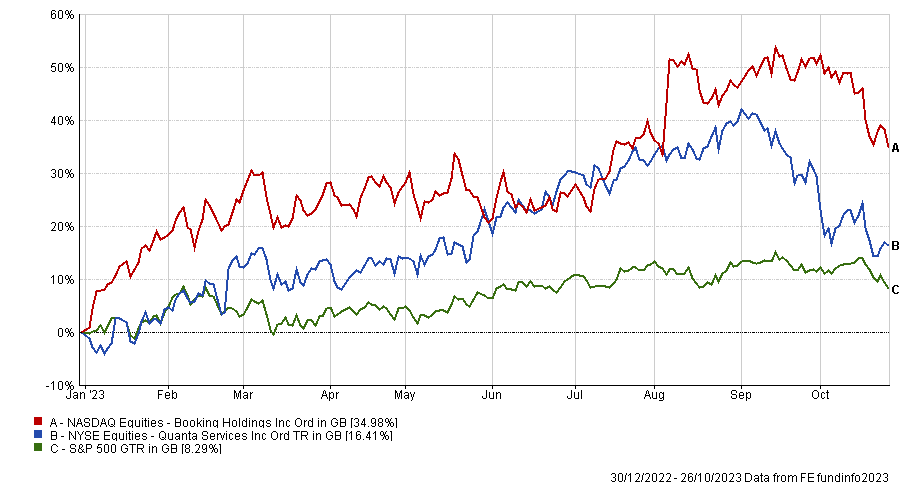

Harris acknowledged that it’s been a narrow market, but said that there have still been opportunities outside of the Seven.

For instance, Quanta Services, an infrastructure provider for renewables and online travel agency Booking, has been among the main contributors to the performance of the JPMorgan American investment trust year-to-date.

“None of these are running because of AI. There's lots of great companies out there alongside the Seven,” Harris said.

Performance of stocks YTD

Source: FE Analytics

While Harris the AI rally as a “pivotal moment” for generative AI, the trust has been trimming its position in Nvidia to take some profits and added to Lam Research, an equipment supplier to the semiconductor industry instead.

It also exited its position in Conoco Phillips, a company specialised in hydrocarbon exploration and product and replaced it with EOG Resources, a competitor.

JPMorgan American IT also added M&T Bank, a bank operating on the eastern coast of the USA. While US banks came under scrutiny in the first quarter of the year following the collapse of Silicon Valley Bank, Harris finds the sector attractive.

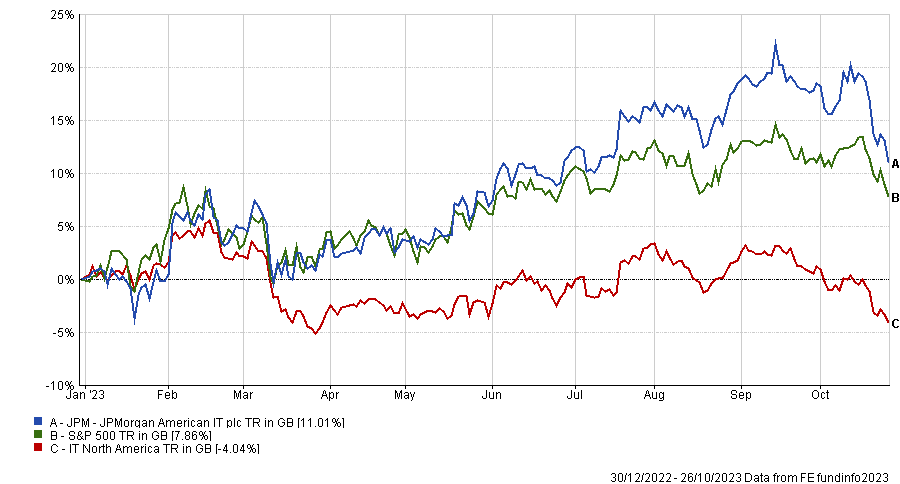

Performance of trust YTD vs sector and benchmark

Source: FE Analytics

She said: “Banks are very cheap and look interesting from a risk-return trade-off perspective. The sector has been through a lot of pain because of the turmoil in March. There’s still risk out there and investor appetite is not really there to support banks.”

Add in sky-high mortgage rates – meaning fewer renewals as people have locked in for longer already – and Harris said “we’re probably very close to the point where the only way forward is up”.