Quilter Investors has added M&G European Strategic Value and ClearBridge Global Infrastructure Income to its range of multi-asset funds. Both have been added to the Cirilium Blend portfolio, while the former also joins the Cirilium Active fund.

M&G European Strategic Value replaces a European value ETF in Cirilium Blend, which typically holds one growth and one value fund for each region.

Richard Halle and Daniel White have been managing the €1.6bn European fund since September 2018 and have returned 33.4% in the five years to 31 October 2023, which compares favourably to 22.3% for the LM Equity – Europe including UK sector in euro terms, as the below chart shows.

Performance of fund vs sector over 5yrs

Source: FE Analytics

Ian Jensen-Humphreys, portfolio manager for the Cirilium range, said Halle and White invest in “companies that are underappreciated, preferring to take a long-term view and wait for the turnaround in investor attention and sentiment”. They follow a “simple, repeatable process” and take environmental, social and governance (ESG) criteria into consideration.

The Cirilium portfolios are positioned cautiously so Jensen-Humphreys and his co-managers, Sacha Chorley and CJ Cowan, have chosen two funds with “predictable outcomes”.

“Going forward, it will be crucial to keep an eye on earnings and what this does to valuations. Rates are beginning to bite, but the direction for revenues is still uncertain and it is too early to time what central banks will be doing in the near future,” Jensen-Humphreys explained. “As a result, we are positioned fairly cautiously, and would prefer to bide our time until clearer opportunities arise.”

Quilter selected ClearBridge Global Infrastructure Income to protect against inflation and provide real returns. It invests in listed infrastructure companies globally and focuses on reliable income streams as well as capital growth.

“Growth is slowing, though not too severely, while inflation is falling – albeit much slower than most of us would like,” Jensen-Humphreys said. “While inflation has moderated, it still poses a challenge to many investors. That is why we particularly liked the long-term, inflation linked aspect of the ClearBridge fund.”

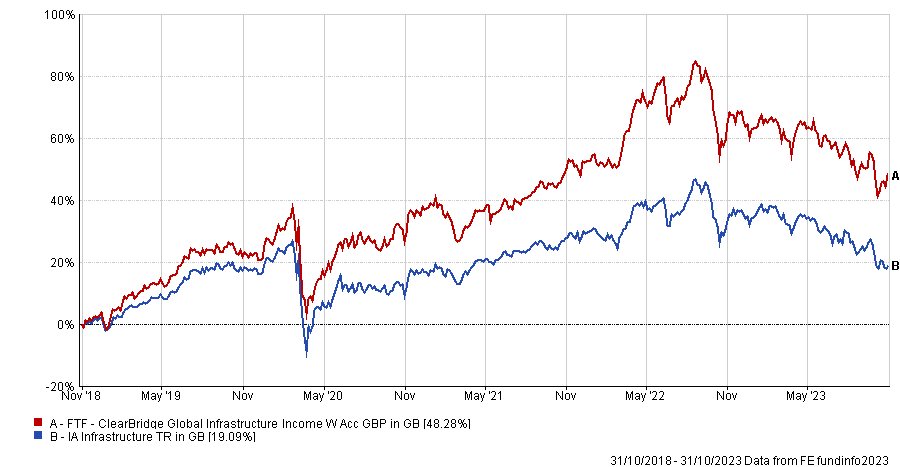

Performance of fund vs sector over 5yrs

Source: FE Analytics

The £1.3bn fund is managed by Charles Hamieh, Daniel Chu and Nick Langley. Performance is second quartile over one and three years and top quartile over five years compared to the IA Infrastructure sector.