Energy funds have surged back in popularity after enormous returns over the past three years, but is the asset class worth holding separately?

Oil and other energy-related assets made for a poor investment in the post-financial crisis era of low interest rates and inflation, but have benefited from numerous factors in recent years, including scarce supply driven first by the pandemic and then the war in Ukraine.

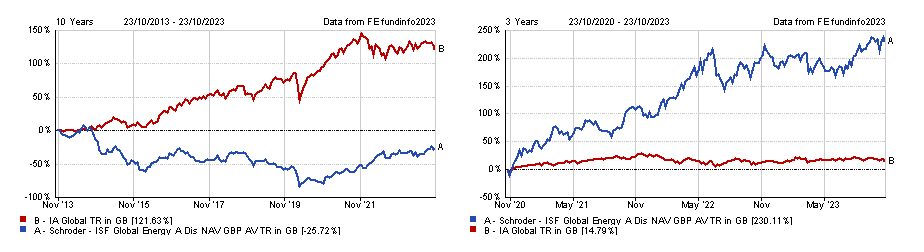

The Schroder ISF Global Energy fund embodies the volatile nature of investing in energy. It was the worst performing portfolio in the IA Global sector over the past decade and was the only one of its peers to make a loss over the period, down 25.7%.

Performance has turned around sharply over the past three years, however, with its 230.1% return the best in the peer group and dwarfing the 14.8% average delivered by most IA Global portfolios.

Total return of fund vs sector over the past three and 10 years

Source: FE Analytics

Here we asked fund pickers whether the energy sector – and the Schroder ISF Global Energy fund specifically – are worth buying.

When judging the Schroder fund, Charles Stanley chief investment officer Rob Morgan said it is fairer to compare it to the MSCI World SMID Energy index than its peers in the IA Global sector, most of whom have a more diversified investment universe.

The index of 221 energy companies from around the globe was down 2.9% over the past decade, which is better than the Schroder fund, but by a narrower margin. Measuring it against this benchmark better reflects the challenges faced by the energy sector over the past 10 years.

Schroder ISF Global Energy may have dropped behind in down markets, but its performance during the good times of the past three years has been over 4.5x better than the index’s 49.6% return.

With energy prices potentially rising further over the coming years, Morgan said this resurgence could continue and be an appealing investment theme.

Fairview Investing director Ben Yearsley agreed, noting the case for investing in funds such as Schroder ISF Global Energy is still strong despite its recent exceptional performance.

“The simple reality is that oil and gas has been underinvested for many years, whilst at the same time demand has been increasing,” he explained.

“It doesn’t matter what the politicians tell us – we will be reliant on oil, gas and fossil fuels for decades to come. This means as an investor, you can make money.”

Yearsley said he will continue to invest in the Schroder fund, but also highlighted Guinness Global Energy as a strong option for investors wanting exposure to the sector.

Unlike the Schroder portfolio, it generated a positive return of 16.6% over the past decade despite operating in a challenging environment for energy funds.

Total return of fund vs sector and benchmark over the past 10 years

Source: FE Analytics

The $406m portfolio is concentrated into 35 names selected by mangers Will Riley and Jonathan Waghorn, who have run the fund since 2010 and 2013 respectively.

Researchers at FE fundinfo praised their expertise in the field, stating: “The fund is sector-focused and, as such, may exhibit greater volatility than the wider global equity market.

“It provides a concentrated exposure to traditional energy companies and the team consists of extremely experienced investors in the market, who have been through several energy market cycles.”

Another option for those who want to play energy in their portfolios is to go with a tracker such as iShares MSCI World Energy UCITS ETF rather than a specialist fund, according to Morgan.

Not only does it have a low ongoing charges figure (OCF) of 0.25%, but it gives investors exposure to smaller energy companies that aren’t as represented in larger funds.

However, he warned that investors wanting to allocate to energy on the back of this upward outlook should make sure they are not overlapping with existing holdings.

Energy companies account for 12% of the FTSE All Share index with Shell and BP two of its largest constituents. This means investors in the region likely have a large exposure to the sector already.

Morgan said: “Energy can be an important component of many funds, especially those taking an equity income or value-orientated approach, so it is important to avoid doubling up on exposure.

“If you already own significant amounts in UK equity income funds, you may have this sector covered pretty well. Many investors therefore won’t need the additional exposure that comes from owning a specialist fund.”

Louis Tambe, head of MPS at City Asset Management, shared Morgan’s concern that thematic funds may not offer investors enough diversification. Nevertheless, he did acknowledge that energy is an appealing theme that investors may want some exposure to within their portfolios.

His solution would be to allocate to a broader equities fund such as Man GLG Undervalued Assets, which has a 14.4% exposure to energy alongside other sectors.

“Given the volatility of the energy cycle and the tendency for share prices to overshoot in response to the underlying commodity price, we would prefer to get exposure through a generalist equity fund where the competition for capital is greater,” Tambe said.

“Man GLG Undervalued Assets’ current exposure to energy stocks should be enough to benefit from positive performance in the sector whilst not carrying the same timing or sector specific risk if you allocated to a pure energy fund.”

The £1.2bn fund manged by FE Fundinfo Alpha Managers Henry Dixon and Jack Barrat is up 78.6% since launching in late 2013, beating its peers in the IA UK All Company sector by 33.2 percentage points.

Total return of fund vs benchmark and sector over the past 10 years

Source: FE Analytics

As its name suggests, the fund seeks out undervalued and unloved companies that have the potential to recover and outperform over the long term.

Analysts at RMSR praised Dixon and Barrat’s “extremely disciplined” approach, but noted that it can lead to periods of underperformance, as is the case with energy funds.

“The clear investment strategy and its disciplined application are very much a positive factor, however potential volatility means the fund is best used as a satellite position within the UK equity weighting of a portfolio, acting as a diversifier and defensive option when the market trades at a higher rating,” they said.