Investors aiming to make the best returns over the long term have many ways to play the market, but a good starting point is to consider the risk they are willing to take.

While some prefer to go gung-ho into assets that can shoot the lights out when markets rise, others choose the more conservative approach and aim not to lose too much when stocks tank.

In some areas, there is a clear difference between the two strategies. In the US investors were better off taking on more risk, while in the UK they were rewarded for taking the cautious approach.

In Europe, investors could have picked a winning fund from either camp, according to data from FE Analytics. As part of its ongoing series, Trustnet compares the upside and downside capture ratios of funds in different sectors.

An upside score greater than 100% means a fund has made more than the market when it has been rising. The opposite is true for the downside capture ratio. Both are calculated against a relevant benchmark: for the IA Europe Excluding UK sector, we used the MSCI Europe ex UK index.

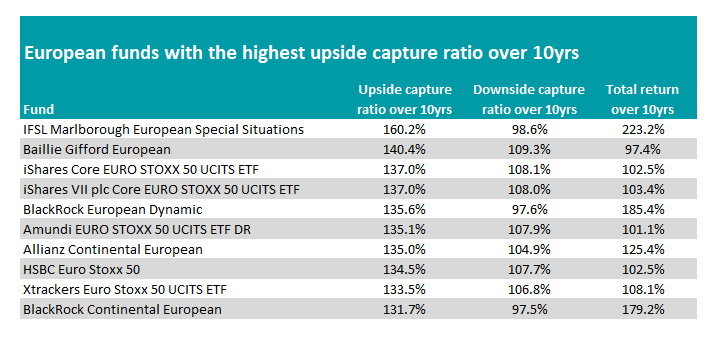

IFSL Marlborough European Special Situations has been the best performer in the sector over the past decade with a return of 223.2%, some 30 percentage points ahead of its next closest rival.

The fund, managed by FE fundinfo Alpha Manager David Walton, has a large mid- and small-cap bias, with just 14.6% invested in the largest European names.

It has performed best when markets have risen, with an upside capture ratio of 160.2%, while it has also done well during tougher times, with a downside capture ratio of 98.6%, meaning it has made a slightly smaller loss when the market is down.

Source: FE Analytics

Growth-oriented Baillie Gifford European has the second-best upside capture ratio of all European funds. Headed by Stephen Paice and Chris Davies, the fund’s 140.4% upside capture ratio however did not mitigate its 109.3% downside score. As such it was the worst performer on the list above, due to its lopsided results.

However, analysts at FE Investments recommended the fund, noting it would be “most suited to a portfolio with a long-term investment horizon as well as one that can tolerate high volatility”.

Also of note is BlackRock European Dynamic, managed by Alpha Manager Giles Rothbarth, as was the second best performer on the list (fourth overall in the sector). It had an upside capture ratio of 135.6% and, like the Marlborough fund above, had a downside score below 100%.

Analysts at Barclays Smart Investor, who recommend the fund, said: “This is a dynamic fund managed by one of the most experienced and talented European equity teams. We believe this is really important as the experience and rigorous research process helps drive successful stock selection and ultimately performance returns.”

From the same stable, BlackRock Continental European also made the list. With the sixth highest return in the sector over the past decade, the fund – also run by Rothbarth alongside Stefan Gries – completes the top 10 with an upside capture ratio of 131.7%.

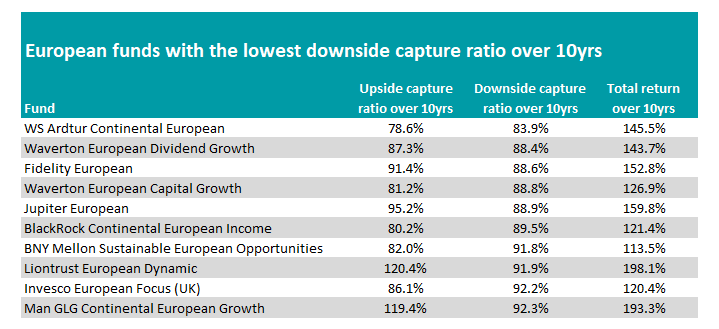

However, not all funds made their gains by trying to beat the market on the way up. Indeed, Liontrust European Dynamic – the second best performer in the IA Europe Excluding UK sector over 10 years – had one of the lowest downside capture rations (92.2%).

Managed by James Inglis-Jones and Samantha Gleave, the fund achieved this while still posting an upside score of 120.4% and made investors a total return of 198.1% over the period.

Analysts at Square Mile Investment Consulting & Research gave the portfolio an ‘A’ rating and said: “There is a high representation of quality companies in the portfolio and the long-term performance record of the fund is excellent and suggestive that the managers are identifying anomalously priced securities.”

Source: FE Analytics

Rory Powe and Virginia Nordback’s Man GLG Continental European Growth fund made the third highest return in the sector and also made the list of funds with the lowest downside capture ratio, squeaking onto the list in 10th place.

The portfolio has two parts. The first is to buy ‘established leaders’, which must make up at least 50% of the portfolio, while ‘emerging winners’ may only make up a third at most.

Analysts at FE Investments said it was a “punchy way” to invest in Europe, despite its downside capture ratio figure, as the top 10 names make up around half of the overall portfolio.

“This top-heavy weighting can lead to greater volatility if several of its companies fall at the same time, and as such the fund is a punchy way to invest in Europe,” they said.

Alpha Manager Samuel Morse and Marcel Stotzel’s Fidelity European as well as Alpha Manager Mark Heslop and Mark Nichols’ Jupiter European were also among the 10 best returning funds of the decade to appear on the above list.

This is part of a series looking at the best aggressive and cautious funds in different sectors over 10 years. Previously we have looked at emerging markets funds, global, US, UK all companies and UK income portfolios.