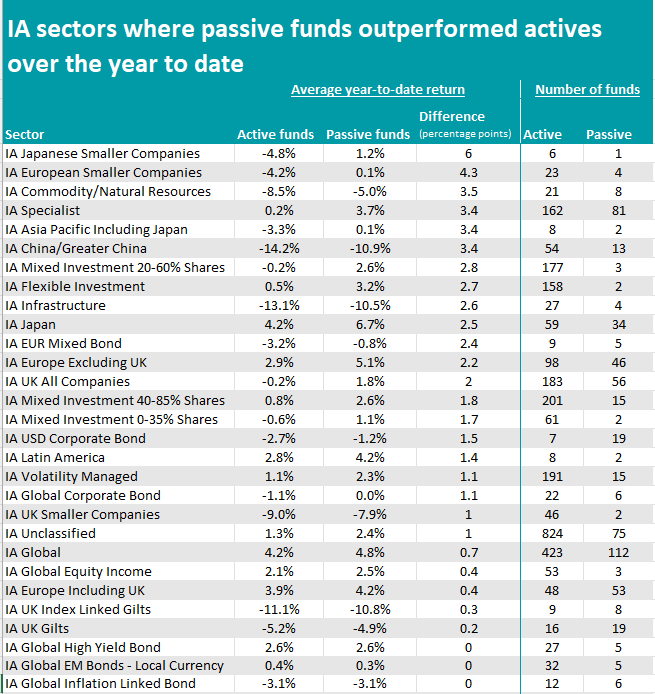

Investors have been better off buying a passive fund rather than an active strategy in the majority of Investment Association universes so far this year, according to data from FinXL.

In 29 out of 50 Investment Association sectors trackers funds came out on top, however the differences between sectors were stark.

The most significant outperformance of a passive fund was in the IA Japanese Smaller Companies sector, where the only passive strategy, iShares MSCI Japan SmallCap UCITS ETF, beat five active portfolios out of six, outperformed them by an average of 6 percentage points.

Source: FinXL

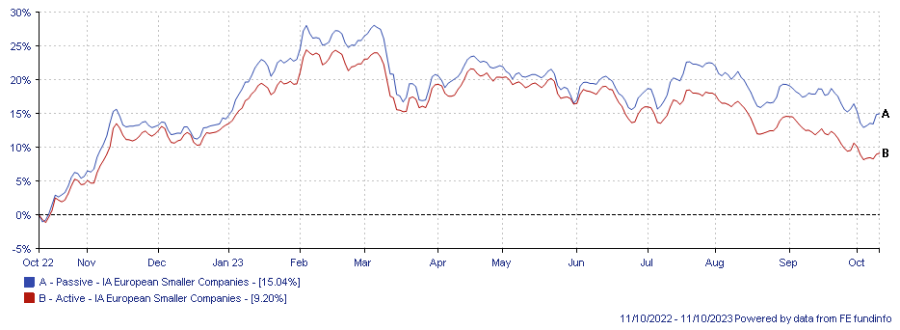

The same was true for the IA European Smaller Companies sector, where the four exchange-traded funds (ETFs) iShares Euro Stoxx Small, iShares MSCI EMU Small Cap, SSGA SPDR MSCI Europe Small Cap and SSGA SPDR MSCI Europe Small Cap Value Weighted beat the average performance of all the 23 remaining actives by 4.3 points.

Return of active vs passive funds over the past year

Source: FE Analytics

Investing in commodities was also more convenient through passive vehicles. Over the year so far trackers returned an average 3.5 percentage points more than active solutions.

Outside of the top three, passives distinguished themselves in China, Japan and Latin America as well as in all four multi-asset sectors, where a plethora of active strategies couldn’t keep up with a handful of passives.

Other notable sectors include IA UK All Companies, IA Global and IA Global Equity Income.

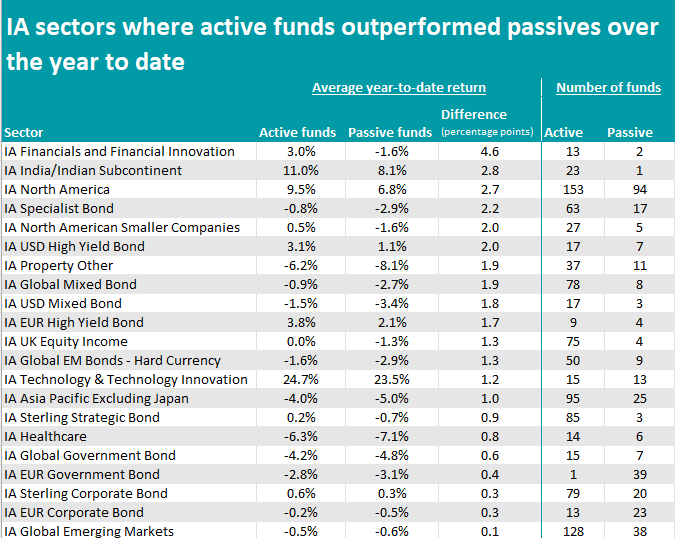

On the other side of the coin, actives prevailed in the most successful sectors of the year so far, including IA North America and IA Technology & Technology Innovation. The latter, at 23.9%, has generated the highest returns among all IA sectors over the year-to-date, with the average return of the 13 passive funds 1.2 percentage points behind the average active.

IA North America has also been among the top five sectors of 2023 so far, and it was another one where it paid to go active.

Source: FinXL

But the scale tilted in favour of actives especially in the IA Financials and Financial Innovation sector, where the distance to the two passively managed ETFs Xtrackers MSCI World Financials and Xtrackers MSCI USA Financials to the rest of the sector was 4.6 percentage points. Xtrackers MSCI USA Financials was the worst performer of the sector at -2.1% over the year to date.

IA India/Indian Subcontinent was the second-best peer group with an average return of 10.8%, which the best-performing fund, Jupiter India Select, almost doubled. In contrast, the passive Franklin FTSE India UCITS ETF only returned 8.4%.

Active funds beat passives in the majority of fixed-income sectors, except IA EUR Mixed Bond, IA USD Corporate Bond and IA Global Corporate Bond, where passives outperformed.

IA Global Inflation Linked Bond, IA Global EM Bonds - Local Currency and IA Global High Yield Bond were the three sectors where the performance of passives was in line with that of active funds.