Baillie Gifford China Growth Trust manager Sophie Earnshaw is avoiding global companies as deteriorating relations with the rest of the world creates new risks.

China’s strained relationships with other countries around the world has made the FE fundinfo Alpha Manager nervous about Chinese companies that are trading internationally.

While not ideal, Earnshaw has tried to make the most of the situation by upping exposure to domestic companies that could benefit from further isolation.

In the portfolio today, 85% of its holdings’ revenues come domestically from China, with around 5% reliant on the US.

“We tried to factor geopolitics into our stock analysis on a stock-by-stock basis, and we’re more inclined to invest in companies with strong domestic exposure where further decoupling is likely to be a net benefit rather than a net negative,” Earnshaw said.

“We take some comfort from the fact that the deterioration in US/China trade relations is unlikely to impact on China's recovery, given the domestic demand is now the major driver behind the Chinese economy.”

Increased consumer spending could be a key area for growth now that people in China are out of strict Covid lockdowns and spending again – it could also be one of the areas to benefit most from deglobalisation.

Earnshaw highlighted a growing trend of Chinese consumers favouring domestic brands rather than international ones, especially among younger people.

There are 300 million Gen-Z consumers in China that are buying far more domestic brands than older generations who grew up in an age of pro-globalisation, according to Earnshaw.

She said the sales from Gen-Z consumers in China are higher in Li-Ning than Nike when it comes to sportswear and the same can be said for Proya in skincare compared to L'Oreal.

“They are likely to become the major driving force of the consumption upgrade and they're very different from their parents in the sense that they're much more culturally confident,” Earnshaw explained.

“By investing in multinational companies, you're increasingly not able to get access to this growing pool of capital.”

Indeed, China has a rapidly ageing population with a large proportion of people reaching retirement age. Having a significant number of the working population in favour of Chinese brands could be a good tailwind for domestic consumer companies.

However, investing in domestic Chinese companies can come with its own set of risks. Managers such as Fundsmith Equity’s Terry Smith have said in the past that investors who buy Chinese businesses are essentially going into partnership with the government.

Earnshaw is aware of this risk and only invests in private companies that adhere to the UN Global Compact principles – a set of 10 fundamentals relating to human rights, labour, environment and anti-corruption.

“It's no secret that China has committed serious human rights abuses that are terrible and should be condemned,” Earnshaw said.

“Our approach when it comes to investing is to be very selective. We're running concentrated portfolios, the vast majority of the companies within which are private in the sense that they are not affiliated with the Chinese government – they're run by founders and entrepreneurs.”

A study by abrdn’s Sustainability Institute found last year that strict selectivity is essential when investing in domestic Chinese names if investors wish to avoid unethical companies linked to the government.

“In our experience, China is a market where investors need to be active, not just in stock selection but across the investment process – in due diligence, portfolio management and engagement,” the report found.

“The type of environmental, social and governance analysis required to invest in China is deeper and more nuanced than for many other markets.”

It also noted that the widely held belief that the Chinese market is dominated by state-owned enterprises (SOEs) is a common misconception.

That may be the case for the market as a whole, but almost half (48.4%) of the nation’s 100 largest companies are state-owned, according to the Peterson Institute for International Economics (PIIE). Only 39% of those businesses are entirely non-public.

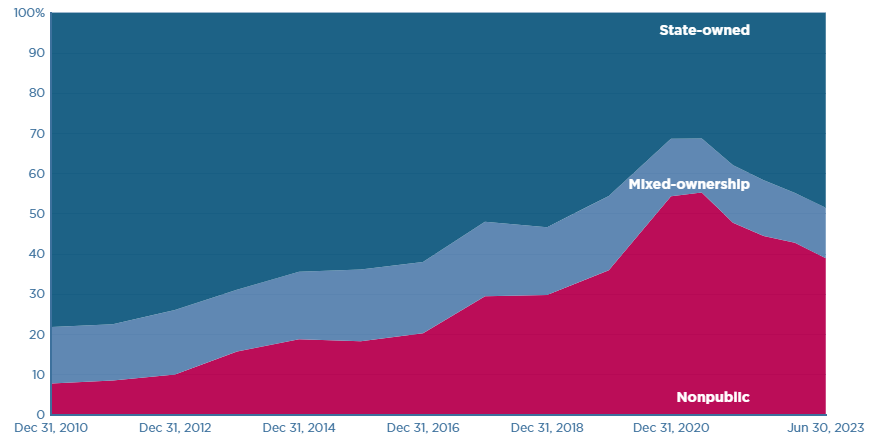

Share of aggregate market capitalization of China’s top 100 listed firms

Source: PIIE

The number of SOEs within the largest Chinese names has shrunk somewhat over time, down from 78.1% in 2013, but Tianlei Huang, senior research staff at PIIE, said it has picked up again in recent years.

“Recent measures of the expanding state sector contrast with the advance of the private sector during the decade preceding mid-2021,” he added.