The US has delivered the highest returns of any region over the past decade, hence its dominance in global benchmarks such as the MSCI World, where it accounts for 69.9% of the index.

Investors seeking direct exposure to the high-growth market may want to buy a fund in the IA North America sector, but that doesn’t mean they have to go for the big conventional names.

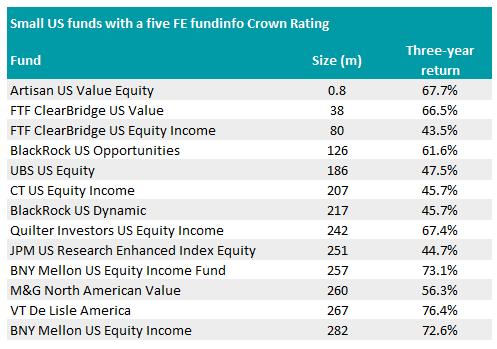

A large fund may offer some perceived safety, but Trustnet found 13 portfolios in the sector that gained a five FE fundinfo Crown Rating despite having less than £300m in assets under management (AUM).

To gain the top ranking, a fund must demonstrate that it is within the top 10% of all Investment Association (IA) funds on alpha, volatility and consistent outperformance over a three-year period.

Source: FE Analytics

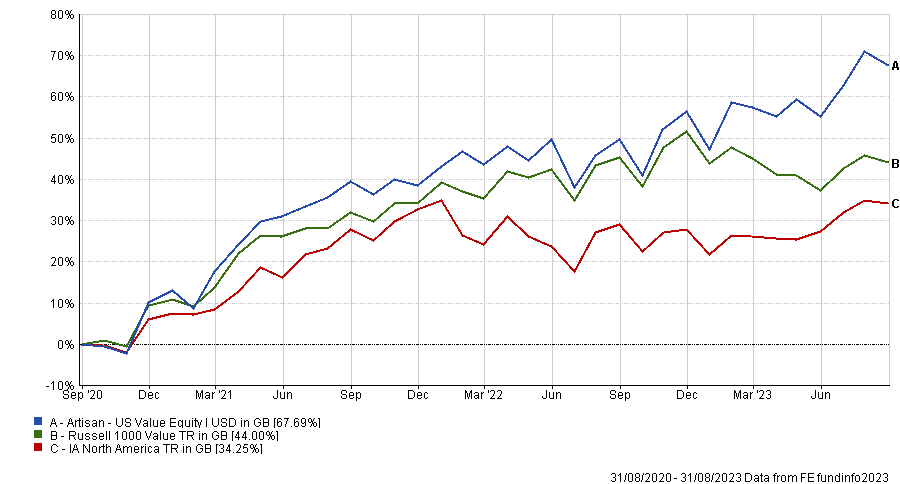

The smallest fund to be awarded the distinguished top ranking was Artisan US Value Equity, which is just $800,000 in size.

Due to their popularity and high gains, equities in the US are among some of the most expensive in the world, but managers Daniel Kane, Tom Reynolds and Craig Inman beat the market by investing in undervalued companies.

They generated a 67.7% return over the past three years, more than doubling the performance of their peers in the IA North America sector despite the fund’s small size.

Total return of fund vs benchmark and sector over the past three years

Source: FE Analytics

The fund is not available on most platforms, but requests to buy the portfolio can be made directly through Artisan Partners.

Even the lowest performer on the list – FTF ClearBridge US Equity Income – beat both the S&P 500 benchmark and peer group with a total return of 43.5% over the past three years.

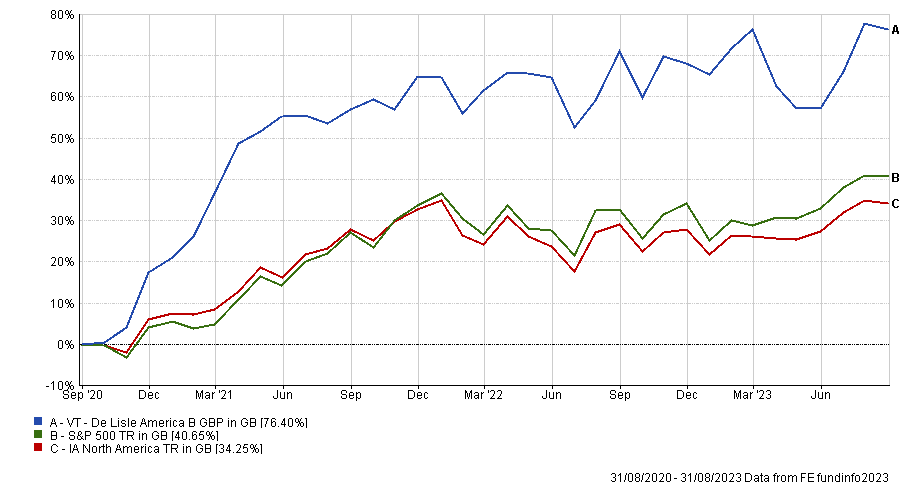

However, the best performance over the period came from VT De Lisle America, which soared a sizable 42.2 percentage points ahead of the sector average with a total return of 76.4%.

Total return of fund vs benchmark and sector over the past three years

Source: FE Analytics

It was the best performing active fund in the sector over the past three years, with manager Richard De Lisle investing more than half of the £267m portfolio in small-caps.

By doing so, it avoided much of the ups and downs that US mega-cap technology names faced in recent years as rising inflation and interest rates presented new challenges.

With around a third of all assets in the energy sector, VT De Lisle America instead had a tailwind from the energy crisis last year, which upped valuations across the sector significantly.

VT De Lisle America may have delivered the best return in the sector over the pas three years, but it also came with some of the greatest volatility of 15.9%.

This was slightly above the IA North America average of 14.6%, but other names on the list delivered top returns with smoother performance.

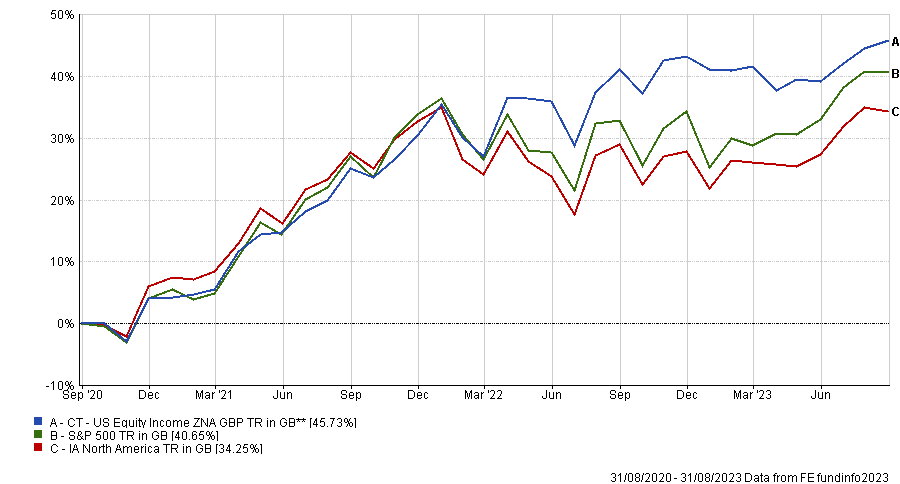

CT US Equity Income was the least volatile at 10.4%, yet its total return of 45.7% was still 11.5 percentage points better than the peer group average.

Total return of fund vs benchmark and sector over the past three years

Source: FE Analytics

Alternatively, some investors might want prioritise a low fee, preferring to seek out a fund that delivered top returns for a cheap price.

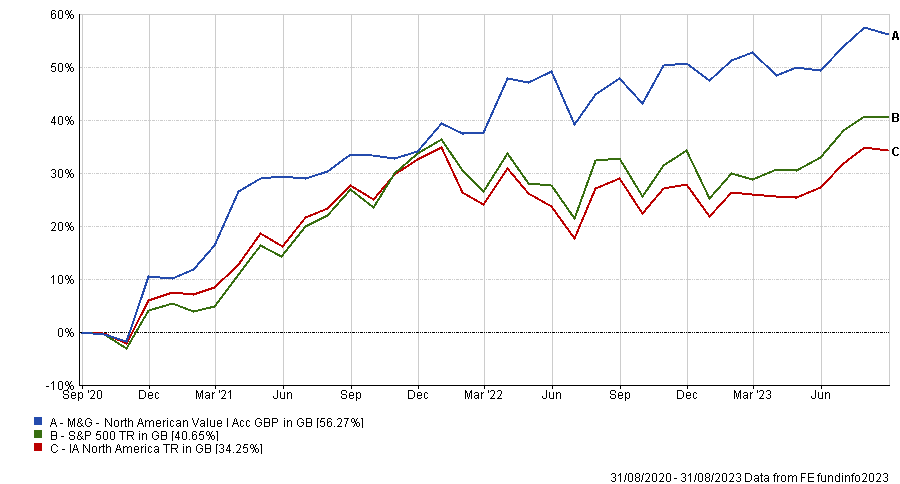

M&G North American Value had the lowest ongoing charges figure (OCF) of 0.57% and put in a strong performance over the past three years.

Managers Daniel White and Richard Halle made a total return of 56.3% over the period, outdoing the average fund in the sector by 22 percentage points.

Total return of fund vs benchmark and sector over the past three years

Source: FE Analytics