UK equities have been trading on cheap valuations for many years as a result of Brexit, Covid and political instability. Yet, there are signs of renewed optimism.

For instance, Franklin Templeton noted that outflows from UK equities have slowed in recent times. Moreover, a fall in inflation in the UK may be in sight, although inflation is still far higher than the Bank of England’s 2% target.

Therefore, there is a possibility that markets re-rate UK equities, which means that now is a good time to position yourself if you expect this scenario to pan out.

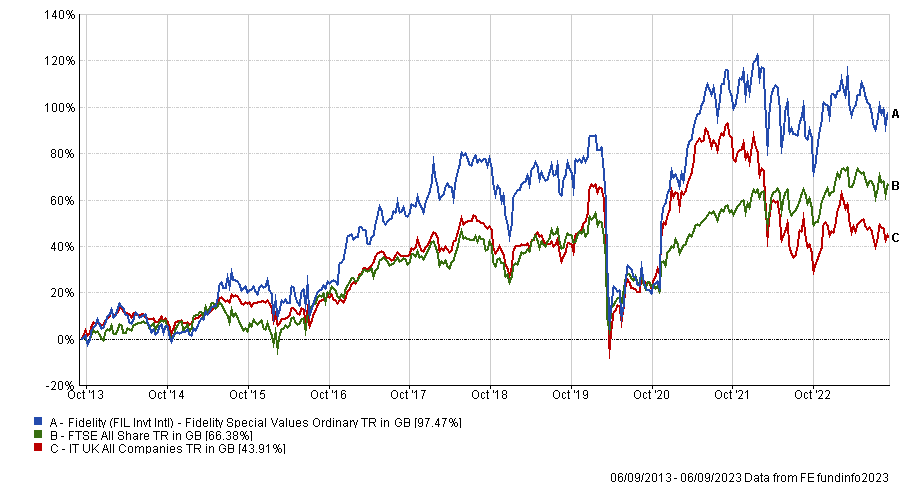

For that purpose, experts are backing Fidelity Special Values, which has made a top-quartile return over 10 years in the IT UK All Companies sector.

Performance of trust over 10yrs vs sector and benchmark

Source: FE Analytics

It was on the recommendation lists of trust selectors Winterflood and Numis at the beginning the year and both companies continue to back it. A reason for this is due to FE fundinfo Alpha Manager Alex Wright, who has been at the helm since 2012.

Michael Clough, research analyst of funds, Investec Wealth & Investment, said: “We rate Wright highly as an individual having been impressed in updates with him over the years, as he regularly demonstrates well thought out and well executed investment ideas.

“He also demonstrates clear use of the wider analyst team at Fidelity, which is encouraging given the depth of resources available.”

Wright’s strategy is about looking for unloved stocks where the downside is limited by cheap valuation and there is a catalyst for change, such as a change in management, an improving competitor landscape in which a business operates and M&A activities.

It is, however, not a ‘deep value’ style portfolio investing in companies at the start of a transition story when risks are potentially higher. Instead, there is a balance between businesses nearer the start of their respective transitions and those further along the journey where the market has started to appreciate the change.

Emma Bird, head of investment trust research at Winterflood, said: “The focus on special situations with the potential for positive change means that performance should be driven by stock selection, with the fund able to perform well across different market environments, not just when ‘value’ outperforms.”

Gavin Trodd, associate of investment companies research at Numis added that there will be periods where performance is distinctly different from the index, which is exacerbated by a bias towards small- and mid-caps. In fact, over half of the portfolio is allocated to UK smaller companies.

As this part of the market is particularly cheap, Trodd said that now could be a good starting point for returns.

Yet, Anthony Leatham, research analyst at Peel Hunt, warned that this bias can increase the economic sensitivity of the portfolio

He added: “Whilst we see the higher beta as a positive, other investors might consider this a risk.”

Another potential weakness of the portfolio is the wider pool of assets managed in the strategy as the trust holds 114 stocks.

Clough said: “Running a pool of assets that is too large makes it harder to invest dynamically and harder to allocate significantly to individual smaller-cap stocks, which can impede alpha generation.”

Structurally, the trust is in good shape. It is the second-largest trust in the IT UK All Companies sector, with a market cap of £869m. Data from the Association of Investment Companies shows that the trust is geared at 4%, leaving scope for increases.

The discount, however, is particularly relevant and arguably a reason why the trust could be a better choice than the open-ended version, Fidelity Special Situations. It currently stands at 9%, which is tighter than the IT UK All Companies peer group average discount of 12%.

Bird said: “The trust has traded at a premium to the peer group for most of the past five years and the board’s commitment to ‘maintain the discount in single digits in normal market conditions’ limits downside discount risk.”

What should you pair it with?

While experts unanimously backed Fidelity Special Values, its particular style means that investors can easily pair it with another UK portfolio bringing something different to the table.

Clough said: “To me it makes sense to blend this trust with a strategy with a clearly articulated quality or growth philosophy investing higher up the market-cap segment.

“A combination of these will smooth out the stylistic gyrations that could drive relative returns of the individual funds at times.”

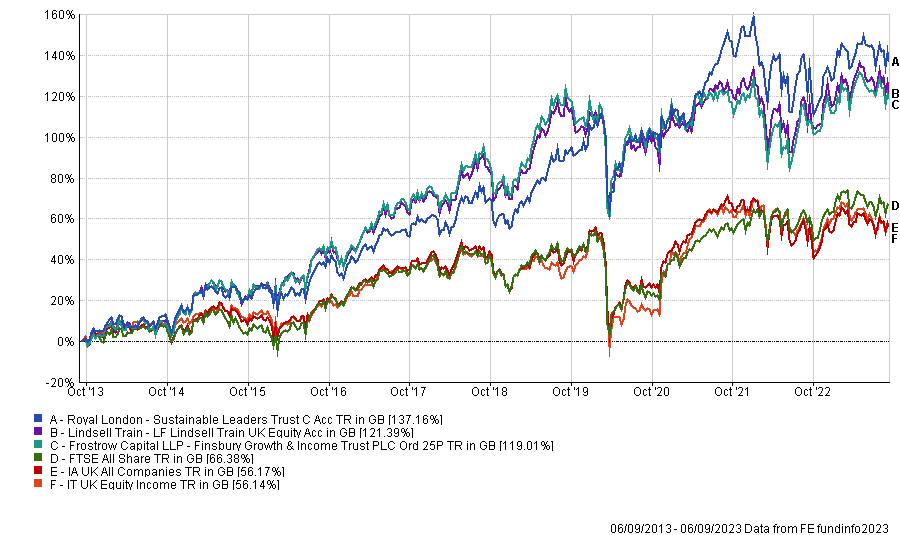

Therefore, he suggested either Royal London Sustainable Leaders or Lindsell Train UK Equity (or its close-ended version, Finsbury Growth & Income).

Performance of funds over 10yrs vs sectors and benchmark

Source: FE Analytics

Royal London Sustainable Leaders is managed by FE fundinfo Alpha Manager Mike Fox as well as George Crowdy and Sebastien Beguelin. The investment style combines sustainable principles with in-depth company financial analysis, which has enabled it to beat its peers and the wider-market over the long-term. It has also been one of the most consistent funds of the past decade in the IA UK All Companies sector.

Lindsell Train UK Equity and Finsbury Growth & Income are managed by FE fundinfo Alpha Manager Nick Train. The portfolios have a quality-growth approach, focusing on well-known and cash generative UK companies, operating in areas with high barrier of entries. Both are concentrated strategies, with the top 10 holdings making up over 80% of the allocation.

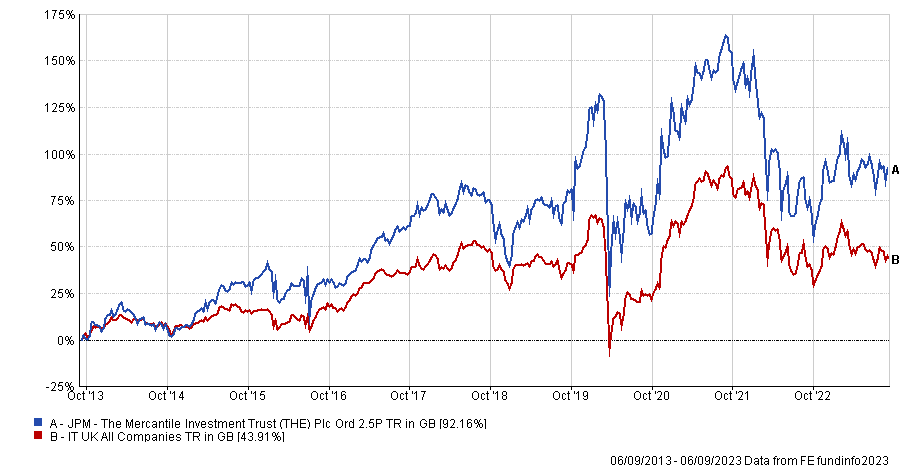

Leatham suggested pairing Fidelity Special Values with Mercantile Investment Trust, a mid-cap specialist with a “quality at a reasonable price” approach.

Performance of trust over 10yrs vs sector and benchmark

Source: FE Analytics

He said: “Both have the potential to rebound, both stand to benefit from increased M&A activity, and MRC is also inexpensive on 14% discount. They have a different style-bias but a similar level of manager skill, in our view.”