Investors tend to gravitate towards large funds, especially when it comes to more uncertain markets such as Asia, but some tiny funds can massively outperform their giant peers.

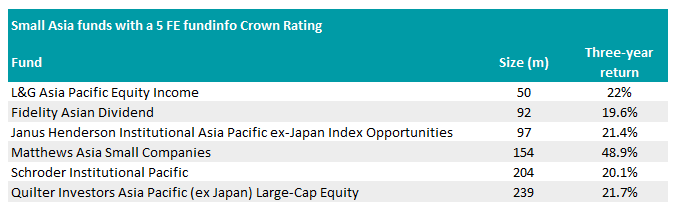

Seeking safety in numbers can feel like sound bet, yet Trustnet found six funds in the IA Asia Pacific Excluding Japan sector given a five FE fundinfo Crown Rating despite having less than £300m in assets under management (AUM).

Only the top 10% of all funds in the investment association (IA) universe are awarded a full five crowns, based on three-year performance relative to the risk taken, so having such a rating distinguishes a fund as being a top performer against the rest of the market in the shorter term.

Source: FE Analytics

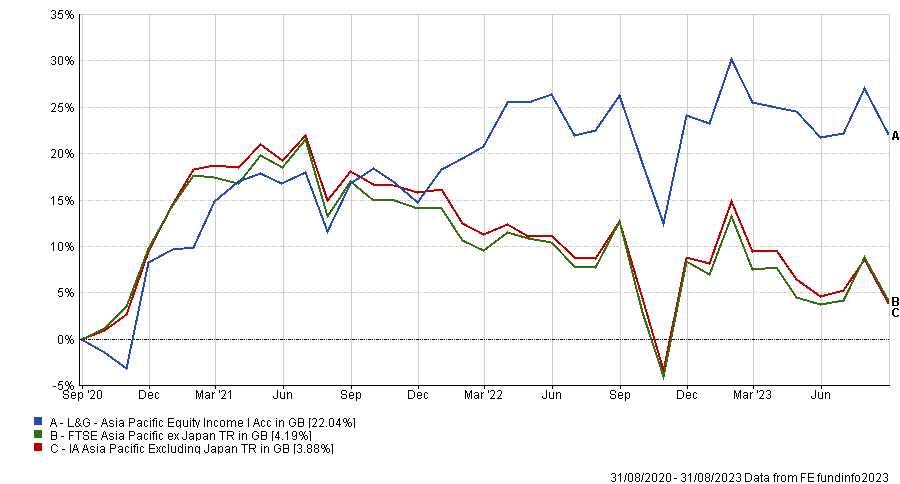

The smallest fund in the sector to gain five crowns was L&G Asia Pacific Equity Income, with £50m in AUM.

It was up 22% over the past three years, soaring 18.2 percentage points ahead of the peer group’s modest 3.9% return despite its small size.

Total return of fund vs benchmark and sector over the past three years

Source: FE Analytics

Managers Ji Shi and Camilla Ayling have built a portfolio of 55 dividend-paying stocks with a preference for companies in China (29.4% of country allocations) and Australia (20.9%). By doing so, it offers investors a yield of 4.5%.

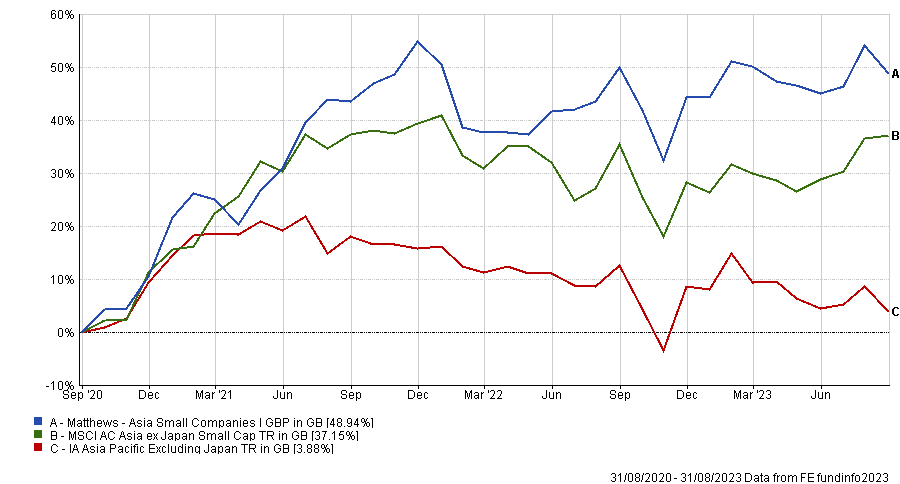

However, the highest total return on the list came from Matthews Asia Small Companies, which rocketed 48.9% over the past three years.

It was the second best performer in the sector over that period, generating a return that was more than 12 times higher than the group average despite its $195m in AUM making it comparatively small.

Total return of fund vs benchmark and sector over the past three years

Source: FE Analytics

Managers Vivek Tanneeru and Jeremy Sutch seek out smaller companies in Asia, particularly in China and India, where more than half (55.9%) of its assets are domiciled.

It has some exposure (10.9%) to large-caps within the $10bn to $25bn range, but the largest bulk of its assets (42.8%) are in small companies below $3bn in market cap.

Matthews Asia Small Companies delivered some strong returns as it invested in early-stage businesses and followed their growth, but it came with the highest price tag, charging an ongoing charges figure (OCF) of 1.15%.

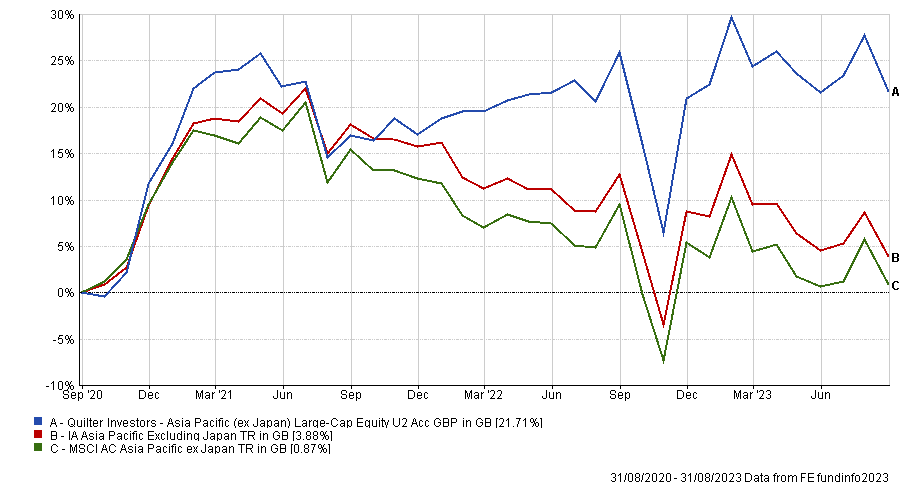

Investors might not mind paying extra for its strong track record, but more cost-aware individuals may want to consider Quilter Investors Asia Pacific (ex Japan) Large-Cap Equity.

With an ongoing charges figure (OCF) of 0.8%, it offered the cheapest route on the list for investors wanting a five-crown fund.

There were two cheaper funds – Janus Henderson Institutional Asia Pacific ex-Japan Index Opportunities and Schroder Institutional Pacific – offering charges of 0.41% and 0.52% respectively, but they are not available to retail investors.

The £239m Quilter fund (the largest on the list) may have been low-cost, but its performance over the past three years was also the most volatile.

Total return of fund vs sector and benchmark over the past three years

Source: FE Analytics

Alternatively, more risk-averse investors could find the lowest volatility over the period from Fidelity Asian Dividend.

This smoother performance came with the lowest three-year return of 18.7%, but it still beat the sector average by a sizable 14.8 percentage points.