Value stocks have been rocked in recent months by heightened volatility but this shouldn’t shake investors’ faith in the investment style, Schroders’ longstanding value team argues.

Much of the post-financial crisis bull run was dominated by growth stocks, which surged thanks to ultra-loose monetary policy and low inflation, while value lagged far behind. Over the decade before ‘Vaccine Monday’ on 9 November 2020, the MSCI AC World Growth index made a 265.6% total return while its value counterpart was up just 99%.

Things changed when the world started to emerge from Covid lockdowns. The release of so much pent-up demand led to supply bottlenecks and inflation. Russia’s invasion of Ukraine added inflationary pressure.

Central banks were forced to start hiking interest rates to curb inflation and the situation continues today. Rising interest rates have put investors off growth stocks as they make the wait for future earnings less appealing, while value has rallied hard.

Performance of value and growth indices since late 2020

Source: FE Analytics

Conditions have shifted again in 2023, though, with growth outpacing value once more. Some of this is down to turmoil in the banking sector following the collapse of Silicon Valley Bank (banks are a classic value sector); this caused value to underperform by a wide margin in March.

However, Schroders’ value team – which runs well-known funds such as Schroder Recovery and Schroder Income – reminded investors that volatility is part and parcel of value investing.

In a note, the team said: “There are people well into their investment careers that are yet to witness value outperforming the market for a sustained multi-year period. However, value has had the upper hand since late 2020.

“So it seems appropriate to offer a timely reminder that within any period of strong performance there will be ups and downs. A heady cocktail of hindsight bias, emotional filtering, cognitive dissonance and memory reconstruction mean human beings will emphasise the good times and do our very best to block out the bad.”

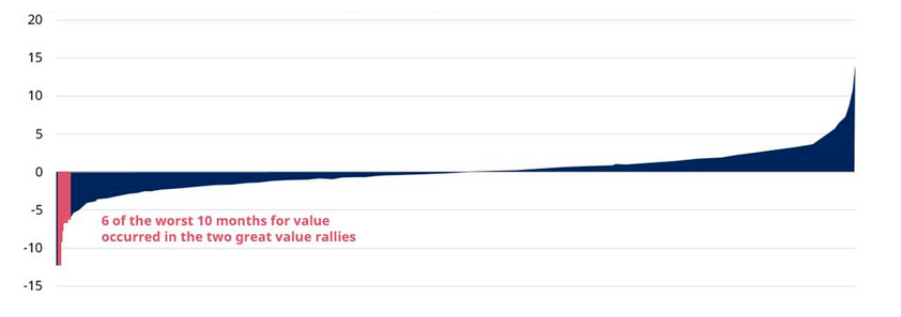

The team highlighted the chart below, which shows the monthly relative returns of the two biggest secular value rallies in modern market history – the mid-70s and the early 2000s. These were multi-year periods of extremely strong relative performance for value and with hindsight “multi-year periods of extremely strong relative performance for value investors”.

Monthly returns of US large value vs growth 1971-2019

Source: Schroders, Russell Investments, GMO, Compustat

But the point is that these strong value rallies also came with some terrible times for value stocks. Indeed, six of the 10 worst months for value versus growth on record occurred during those periods that are now seen as golden days for value investing.

“Our conclusion is that – in the short-term at least – the market is really noisy,” the note said.

“Trying to extrapolate what is going to happen over the next three to five years based on monthly swings in sentiment is a dangerous game because it is hugely misleading. Value has undoubtably had a more difficult month in March 2023 – but history shows this is par for the course.”

What’s more, the team argued that this uncertainty and volatility tends to be a good thing for value investors in the long run.

The “artificially buoyed and protected” quantitative easing market of lower-for-longer rates and low volatility meant that a rising tide lifted all boats and created few opportunities for value investors and periods of weak returns.

“However, when emotions reign, when uncertainty increases, when fear (or greed) takes over, shares prices move by more than is justified by fundamentals and opportunities are created,” it added.

“That is why our funds have tended to perform well after periods of uncertainty. Periods like the tech crash, the great financial crash and the Covid crisis all created the conditions for strong subsequent returns for our unit holders.”