North American and value-focused portfolios have suffered the most from the market shifts that have taken place so far in 2023, as a significant number of funds fell from the first performance decile in 2022 to the 10th during the first quarter of 2023, research by Trustnet shows.

As highlighted in a previous Trustnet story, some investment themes, such as healthcare and China, have surprised for their worse-than-expected returns in 2023, but funds in those sectors aren’t the only ones to have suffered from the market reversal.

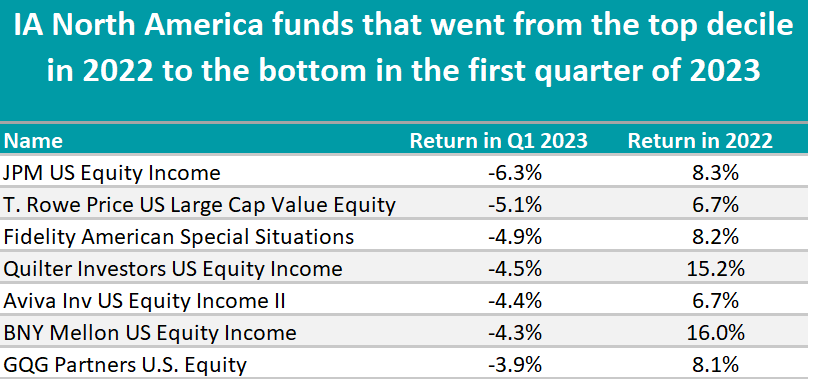

In fact, data from FE Analytics shows that among the active equity funds that fell from riches to rags, the worst hit this year were within the IA North America sector, and in particular, the seven funds below.

Source: FE Analytics

JPM US Equity Income was the North American fund to take the largest fall. Having returned 8.3% over the course of 2022, this £4.3bn strategy with a FE fundinfo crown rating of 5 is down 6.3% this year.

Square Mile Investment Consulting & Research analysts said: “The fund is likely to lag in strong market rallies, especially when led by growth-biased stocks, as these tend not to meet the manager's criteria of yielding at least 2% at the time of purchase.”

With its largest holdings in financials (21.5% of the portfolio) and healthcare (17.4%), it is perhaps unsurprising that the fund struggled this year, although it should “provide some resilience during more troubled times”, according to the researchers.

Income was heavily present in the list, despite income funds’ growing in popularity in 2023. In the US, BNY Mellon US Equity Income dropped 4.3% in the first quarter of this year, giving back some of the 16% gain it made in 2022. European funds were affected too, with VT Argonaut Equity Income losing 5.8 performance points since the end of 2022.

North American value strategies were also loss-making, including the £768.7m Fidelity American Special Situations. Run by FE fundinfo Alpha Manager Rosanna Burcheri, the fund is 20.3% invested in healthcare companies and almost doubled in size between February 2020 and October 2022 but is down 4.9% year-to-date.

Value funds suffered in other sectors as well. In the IA Global, Nedgroup Contrarian Value Equity had a strong year in 2022, up 12.6%, but is another that has dropped so far this year. Other value plays included Dimensional International Value and in Europe, JPM Europe Strategic Value and BlackRock GF European Value.

Global, China and emerging market funds took up the following positions in the list, as shown in the table below.

Source: FE Analytics

Within global strategies, the ones that tumbled the most had significant exposures to the US, such as GQG Partners Global Equity, a $1.7bn FE fundinfo five-crown strategy led by FE fundinfo Alpha Manager Rajiv Jain, who primarily invests in US healthcare.

Schroder ISF Global Energy was different and was hurt the most among all funds in the list, down 3.4% after an impressive 2022 when it gained 48.7%. This is in line with energy companies coming in and off the boil and a milder winter in Europe helping to keep energy demand and prices low.

In China, FSSA All China and GAM Multistock China Evolution Equity had negative returns in 2022, despite being top-decile performers last year. China went through particularly harsh Covid lockdown measures that hindered returns in 2022. Over the year-to-date, the two funds had less negative returns but fell behind the rest of the sector and to the bottom performance decile.

Two UK vehicles were also listed, including Artemis SmartGARP UK Equity, whose main holding in financial companies might have caused an underperformance following the banking scare that ensued the collapse of Silicon Valley Bank and Credit Suisse. HSBC, NatWest and Bank of Georgia are all among the fund’s top-10 holdings.

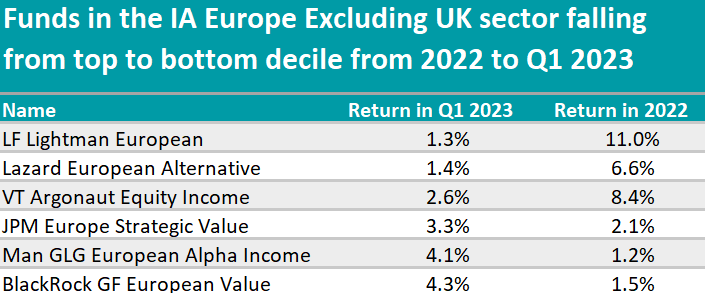

Finally, European funds closed the table.

Source: FE Analytics

Here, LF Lightman European and Lazard European Alternative also shared the same fate as the value and income strategies mentioned before.

Similar in size, the two vehicles are very different from each other – the former, as described by FE Investments researchers, is a fund that can “play the value factor in a light or aggressive way, depending on the macro environment”, the latter is a bottom-up long/short equity fund aimed at capital preservation.

Managed by FE fundinfo Alpha Manager Rob Burnett, in the first quarter of 2023 Lightman European made a 1.3% gain, but fell behind surging peers. FE Investments researchers still back it as “a good addition alongside growth strategies in a portfolio, providing diversification benefits”.