Investors could be forgiven for being more tentative heading into the ISA deadline this year after a disastrous 12 months in which most assets tumbled on the back of higher inflation and interest rates, war in Europe and the hangover of Covid in China lingering longer than expected.

Yet there is reason for optimism, with markets making a strong start to the year – the MSCI World index is already up 6.7% in 2023.

This has provided welcome relief to investors given the cost-of-living crisis that many are going through, with higher energy bills, increased mortgage rates and costlier staples such as groceries.

Rob Burgeman, senior investment manager at RBC Brewin Dolphin, said things may only get worse, with personal tax allowances set to be cut in April and then reduced again next year.

This makes using as much of your ISA allowance as possible more important for the next tax year than it has been in “quite some time”.

“Fortunately, ISAs remain unaffected and everyone can still contribute up to £20,000 for the tax year to either a cash or stocks and shares ISA, with the latter tending to outperform the former over the long term – albeit, past performance is no guarantee of future returns,” he said.

One way that investors may want to put their money to work is to look at stocks with good share price growth potential combined with a reasonable level of income through dividends, known as ‘quality’ stocks.

“These should compound over the long term and grow within the tax-free ISA wrapper,” said Burgeman.

Below, he highlights five stocks that may catch the eye this year, but noted that these should be used as part of a wider diversified portfolio and should be held for the long term.

Unilever

The consumer staples firm behind brands such as Dove shampoo and Wall’s ice cream has come under pressure in recent years as investors have become split on its fortunes.

Last year, Fundsmith Equity manager Terry Smith said that, following Unilever’s failed bid for GlaxoSmithKline’s Consumer Healthcare division, management had “lost the plot” and “run out of ideas”.

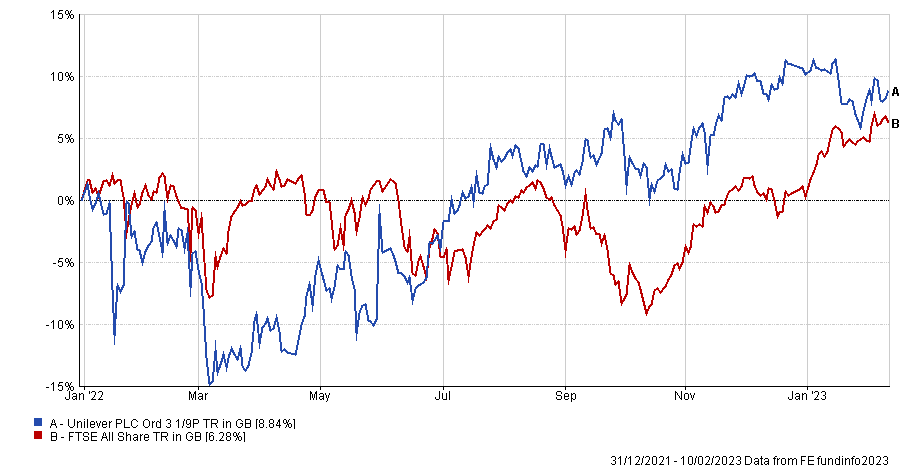

However, shares have rebounded and since the start of 2022 are now up 8.8%, slightly ahead of the wider FTSE All Share index, as the below chart shows.

Total return of Unilever vs FTSE All Share since start of 2022

Source: FE Analytics

“The wonderful thing with a company that owns a broad range of quality brands is that it has some element of pricing power, which enables it to pass on cost increases in higher prices to consumers – a very relevant attribute at the moment,” said Burgeman.

“Having recently appointed a new chief executive, Unilever is expected to continue to refine its brand portfolio, focus on growth, and reduce the discount it trades at compared with some of its peers.”

Diageo

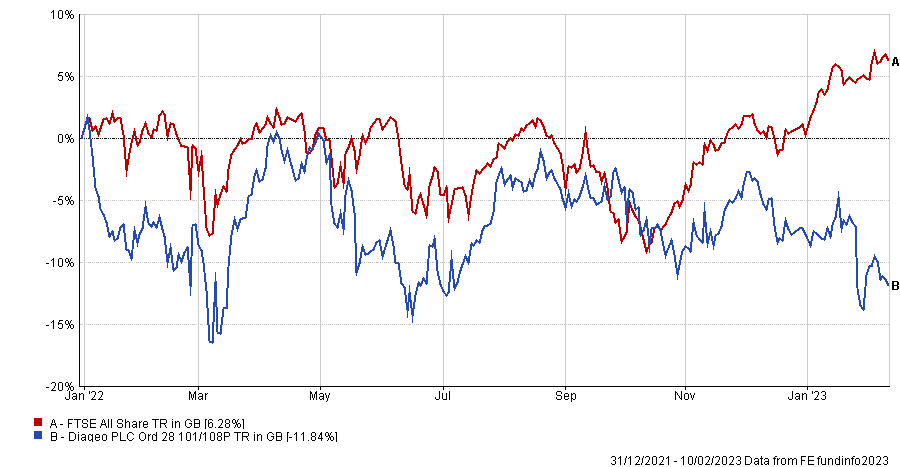

Guinness and Smirnoff maker Diageo is in a similar position, but its returns have underwhelmed recently, with the stock down 11.8% since the start of 2022, as the below chart shows.

Total return of Diageo vs FTSE All Share since start of 2022

Source: FE Analytics

Despite recent poor performance, Burgeman said: “Some stock market stalwarts are just that for a good reason and Diageo is definitely in this category. It runs a series of premium brands, with strong pricing power and a long runway for growth in a highly fragmented global industry. Almost regardless of the economic environment, Diageo looks poised to continue to deliver decent long-term returns to shareholders.”

Earlier this month, veteran stockpicker Nick Train said the stock had annoyed him, and the “galling” performance was below expectations. However, the manager said he had used the opportunity to top up shares.

“This is annoying for me and all fundholders – given it is one of the biggest positions in your portfolio,” he wrote in an update to investors in his LF Lindsell Train UK Equity fund.

“It is particularly galling for me because throughout I have been evangelising on Diageo’s behalf to anyone who will listen to me.”

Barclays

Burgeman admitted a bank may be a “surprise inclusion”, but noted that interest rates at their current levels make for “a far more conducive environment for financial institutions to make money”, as the gap between what they pay on deposit and the rate at which they lend widens.

Banks have had a torrid time post-financial crisis, with Barclays down 25.2% over the past 15 years, while the market has returned 150.4%.

Total return of Barclays vs FTSE All Share over 15yrs

Source: FE Analytics

However, this is the first time rates have returned to more normal levels since then, presenting an opportunity to make a profit, despite the slowdown in the economy. Of course, there are risks, such as the threat of a tidal wave of bad debts and defaults.

“However, while we agree that there is a slowdown, we do not think it is going to be the kind of uber-sharp contraction that we saw in 2008’s Great Financial Crash. Banks remain cheap, their balance sheets are in fine fettle, and there is the realistic prospect of decent dividends and share buybacks. As such, Barclays is our preferred stock in the sector,” said Burgeman.

Disney

Burgeman’s last two picks are US stocks, starting with children’s favourite Disney. The firm operates a broad range of activities in the entertainment and media space, ranging from its film studios to the more recent Disney+ streaming service, which has attracted vast numbers of subscribers.

“At the same time, parts of its business that suffered during Covid restrictions – namely its resorts, theme parks and cruise business – look set to rebound strongly over the next year. The return of Bob Iger as chief executive is also likely to see a refocus of the business on its core values,” said Burgeman.

Booking Holdings

Finally, Booking Holdings is the parent company of travel specialists booking.com and hotels.com, which are starting to recover from Covid.

“As restrictions have all but faded away, a holiday-starved population looks poised to storm resorts across the world,” said Burgeman.

“As an organisation, it is poised to disintermediate the hotel chains, offering consumers easy access to a range of hotels with easy cancellations and low costs. Add to this the opportunity to offer value-added services, like airport transfers and day trips/excursions, and the company looks well placed to benefit from these shifts.”