Big tech names such as Meta, Apple, Amazon, Netflix and Alphabet (FAANG) led the global economy for much of the past decade, but a shift towards value has thrown their dominance into question.

The five giants – jointly worth more than $5trn – are not accustomed to high interest rates and soaring inflation and have had to lay off more than 150,000 employees collectively in recent months.

With their latest quarterly results now revealed to shareholders, Trustnet looks at how each of the FAANGs fared over the past three months.

Apple

Apple lost one third of its market cap in 2022, shedding around $1trn throughout the course of the year. As such, many investors were hoping for positive results in the latest report, but that was not the case.

It disappointed investors in the fourth quarter, announcing yesterday that revenues dropped 5% year-on-year to $117.2bn.

The firm had been one of the better performers in 2022 and although its share price was down 12.8% over the past year, Russ Mould, investment director at AJ Bell, pointed out that revenues at the company have been fairly resilient in the market downturn.

It was the only FAANG not to issue a profit warning last year as earnings were largely in line with what markets had expected.

Share price of Apple over the past year

Source: Google Finance

But there were some signs of struggle, with a profit warning from Apple’s component supplier Nidec and a pay cut for chief executive Tim Cook last year already suggesting weaker revenues.

The tech giant said production delays in China were to blame, but declining consumer interest is a growing concern, according to Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown.

Sales dropped 5% to $95bn as high inflation capped consumer spending, although it’s well established brand could provide pricing power this year.

Lund-Yates said: “Apple missed both sales and profits targets partly because of lower demand for iPhones, which is hardly a surprising development given the economic pressures in its core markets. By its own admission, Apple is in a challenging spot.”

Amazon

Christmas spending boosted net sales 12% to $149.2bn in the fourth quarter, beating the market’s expectations for the period for the large online retailer Amazon.

Consumer discretionary stocks have been under scrutiny from investors questioning how they will perform in a downturn but yesterday’s results are a positive sign for Amazon’s toughness.

Lund-Yates said: “Amazon is a classic bellwether for consumer confidence and the slowdown in activity shines a light on the very real pull back in consumer sentiment and spending.

Overall, operating profit fell to from $3.5bn to $2.7bn in the fourth quarter, with Amazon Web Services proving to be the only profitable branch of the business, generating $5.2bn.

Even with the positive net sales, rapidly declining savings rates in the US could squeeze Amazon’s revenue streams significantly over the coming months, according to Lund-Yates.

She said: “While declines haven’t been as steep as feared, they could become more pronounced. By the middle of the year we could see a pronounced change in behaviour which will hurt Amazon, and all other businesses selling non-essential goods.”

Alphabet

Revenues at Google’s owner, Alphabet, were up a modest 1% to $76bn in the fourth quarter, while operating income dropped 17% year-on-year to £18.2bn.

Gerrit Smit, manager of the Stonehage Fleming Global Best Ideas Equity fund, said: "Whilst Alphabet’s sales have treaded water over the fourth quarter, it is comforting to see they are standing their own and outgrowing their main rival, Meta.”

Shares in the company dropped 24.7% over the past year, but some optimism has been injected into the stock in recent weeks, climbing 20.9% in the past month.

Despite disappointing results, Smit remained confident in the company’s future, stating: "Overall lower group profitability is currently taking its toll on earnings, but is in process of being addressed and should be in process of bottoming out."

Meta

Costs and expenses at Meta rose 22% to $25.8bn in the fourth quarter, while revenue coming into the company fell 4% to $32.2bn.

Overall this resulted in its operating profit dropping by 49% to $6.4bn, however chief executive Mark Zuckerburg’s pledge to boost efficiency could offset some of these losses.

The Facebook owner said that it would ditch several office buildings, abandon several data projects and discharge approximately 11,000 employees in an effort to reduce costs.

Billions are estimated to have been spent on the company’s Metaverse project, which has yet to prove itself to be a profitable venture.

Lund-Yates, said: “While the headcount reductions are never an easy decision, from a strategic point of view many will see this as the right way to go.

“It’s widely understood that Meta is one of the tech giants that stands to benefit the most from headcount reductions.”

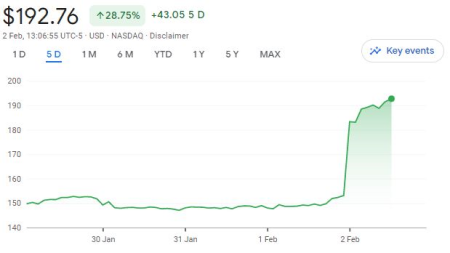

Markets reacted well to Meta’s streamlining measures, with the share price up 28.8% over the past five days. Even so, the company is still down 40.3% over the past year.

Share price of Meta over the past five days and past year

Source: Google Finance

The report also noted that the number of daily active users increased 5% to 2.96bn, much to investors delight. Concerns that other social media apps such as TikTok and Pinterest are muscling in on Meta’s platforms have been on investors’ minds in recent years, but the increase in users is a positive sign.

However, challenges remain, according to Lund-Yates, who said: “Meta getting its house in order is important because times are still tough.”

For example, Apple’s App Tracking Transparency update, which limits the personal data shared with third parties, was introduced in April last year and is expected to have cost advertising platforms billions of dollars. A tight monetary environment is also likely to discourage some companies from buying ad space, limiting inflows to Meta’s largest source of revenue.

Lund-Yates: “The market has been concerned about the company’s bloated expense line and lack of direction for some time, and these results display an effort to address both of those issues.”

Netflix

Revenues were up 10% for Netflix in the first quarter, rising to $7.9bn as a wave of new customers subscribed to the streaming service.

The group added 7.7 million new subscribers over the final three months of the year, blowing its 4.5 million target out of the water.

This was largely boosted by prominent releases such as Wednesday and the Harry and Meghan documentary, but viewership could slow now that hype has subsided, according to Lund-Yates.

She said: “While these wins can’t be knocked, such high profile launches are rare, and we’re likely to see some content stagnation in the coming quarter which will slow the pace of customer acquisitions.”

Even so, the surge in subscribers lifted operating profit to $550m, which was $200m better than markets had anticipated.

Like many of the spending conscious FAANGs, Netflix reduced the pace of hiring over the quarter and cut its content budget to $4bn from $5.7bn a year ago.

With cashflows running freely again, the group has pulled the “thorn in Netflix’s side” and prospects for the company are looking up, according to Lund-Yates.

She said: “Netflix has had to pedal very hard just to stand still in recent times, which is a worrying state of affairs. Now that the top of the subscriber-funnel is flowing once more, it paves the way for longer-term growth.”