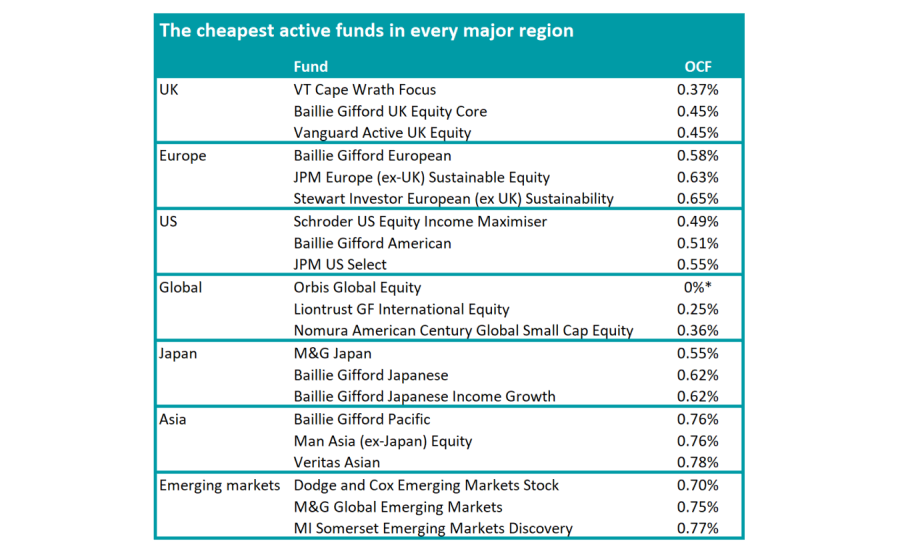

Funds run by Baillie Gifford, M&G and JP Morgan are among the cheapest options available to investors who want active managers in different equity regions.

During times of market stress, investors might attempt to conserve cash at all costs. While this can mean selling out of the market entirely, ridding themselves of all fees and stemming losses, this comes with the risk of also missing out on the gains that come with the eventual rebound.

Perhaps therefore it may be more prudent to focus on the first part of the equation: limiting fees so that if you are making losses, these are not compounded.

Last week Trustnet looked at the cheapest funds in each major equity market sector. In every case, these were passive funds that track the market. However, some investors prefer to use active managers, hoping that their skill can outperform over the longer term.

As such, below we have collated a table of the cheapest active funds available in each major market. We have removed all index trackers as well as any enhanced index and smart beta funds, and for each region have looked at the main Investment Association sector.

Please note that the ongoing charges figures (OCFs) were based off the main driver share class in FE Analytics and charges may vary depending on the share class available.

The cheapest option is the Orbis Global Equity fund, which comes with an asterisk as its unique fee structure means investors are charged 40% of any outperformance of the MSCI World as a performance fee. However, they do not pay if the fund fails to beat the MSCI World index (and are actually refunded for any fees paid previously).

Source: FE Analytics *Orbis charges a performance fee

Outside of this, the next cheapest option for investors is the Liontrust GF International Equity fund, which costs 0.25% per year. The fund was launched in 2019 by Majedie before the company was bought by Liontrust and is managed by Tom Record.

Outside of the IA Global sector, the next-cheapest region is the UK, where VT Cape Wrath Focus costs the least at 0.37%, followed by Baillie Gifford UK Equity Core and Vanguard Active UK Equity, which both charge 0.45%.

Yesterday, Vanguard Europe head of active-passive research Jan-Carl Plagge wrote that it is a “best-kept secret” that Vanguard is one of the largest active fund managers in the world, despite being synonymous with passives.

While passives are the “ideal core holding” if an investor wants to invest in pursuit of market-beating returns and is comfortable with the risk of underperformance, “we think a well-diversified, low-cost active fund could add value to their portfolio over time”, he wrote.

Investors that want exposure to Asia or the emerging markets may be better off in passives, however, if fees are the primary concern.

Although the cheapest emerging market tracker costs 0.15%, the lowest-cost active fund (Dodge and Cox Emerging Markets Stock) charges 0.7%. Similarly, the cheapest Asia ex Japan tracker costs 0.1%, but the low-cost active option (Baillie Gifford Pacific and Man Asia (ex-Japan) Equity) will set investors back 0.76% each.

Baillie Gifford was the fund group with the most entrants on the list, with six funds out of the 21 coming from the Edinburgh-based investment house. Indeed, the only areas that it did not appear in were emerging markets and global sectors, where its funds were just outside the top three cheapest options.

The firm’s growth style has been in vogue for much of the past decade and portfolios have taken in a lot of investors’ cash, which it has used to reduce fees through economies of scale.

Only M&G and JP Morgan were also represented by multiple funds on the list, boasting two funds each.