Making the world a better place might seem a daunting or even impossible endeavour for the average person, but investors seem up for a challenge, as more and more of them are taking environmental, social, and governance (ESG) factors into closer account when building their portfolios.

Sustainability is claiming a nook in everyone’s conscience, spurred, among other factors, by initiatives like World Environment Day, which was celebrated on the 5th of June this year.

Indeed, over the past decade, assets in ESG investment trusts have increased 55-fold, according to data from Hargreaves Lansdown, and this year is no exception.

Analysing the growing interest in ethical investing, the latest Calastone report registered a “stark” contrast between ESG funds, which had an inflow of £2.8bn this year while their non-ESG counterparts suffered net outflows for £3.7bn over the same period.

So, as the range of ESG products and areas of specialism expands, what options are available to an environmentally conscious investor? To add on to Square Mile’s recent selection of five funds to make the world a better place, here are Hargreaves Lansdown’s top-three investment trust to protect the planet.

Opening ESG Analyst Tara Clee’s list is the Impax Environmental Markets trust, which invests in small and medium-sized companies that generate more than 50% of their revenue from the sale of products and services in environmental markets.

“The trust has a real-world impact, with their investments into emission reductions in 2020 equivalent to 850 cars being taken off the road, and investments into water efficiency solutions equivalent to saving the annual water consumption of 4,420 households”, she said.

Over five years, it has outperformed its IT Environmental sector by 34.9 percentage points, as the below chart shows.

Trust’s performance against sector over 5 years

Source: FE Analytics

It is not the only fund in the boutique house’s range to do well, however. Indeed, Impax Asset Management, whose funds and trusts are entirely based on ESG principles, has attracted significant inflows over the past year and made proceeds for £32.7m over six months to the end of March, compared to the £14.4m in the same period of 2021 as investors have focused on doing good with their money.

Claverhouse IT managers William Meadon and Callum Abbot “expect this momentum to continue as their long track record in the ESG space gives them a strong competitive advantage”.

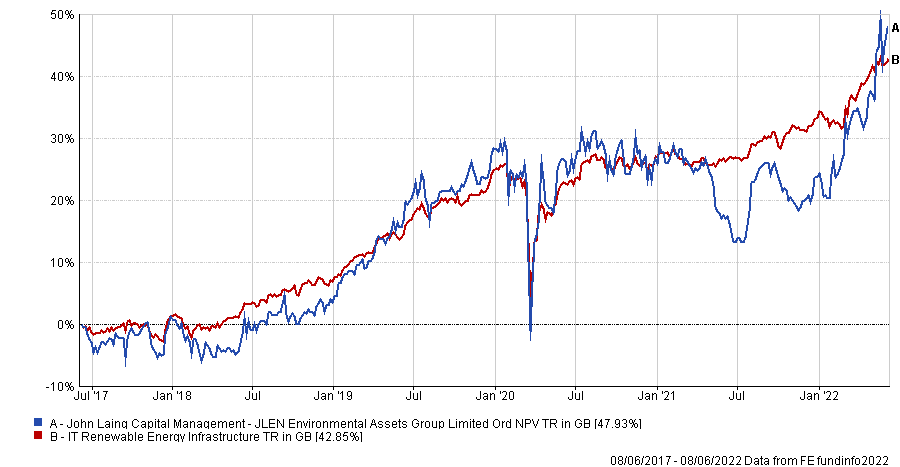

JLEN Environmental Assets Group

Clee also backs JLEN Environmental Assets Group, which promotes the efficient use of resources, to develop positive relationships with the communities it works in, and to ensure effective, ethical governance across the portfolio. It aims to pay investors a progressive dividend every quarter, while sheltering the capital value of its portfolio.

In a recent interview published by Trustnet, manager Chris Tanner explained how the trust, which recently entered the FTSE 250, has benefited from the sharp rise in energy costs and how he prepared for when demand drops again in the “roller coaster ride on power prices” of the past few years.

The fund is up 90.6% since it launched in 2014 and beat its IT Renewable Energy Infrastructure sector by 5 percentage points over the past 5 years.

Trust’s performance against sector over 5 years

Source: FE Analytics

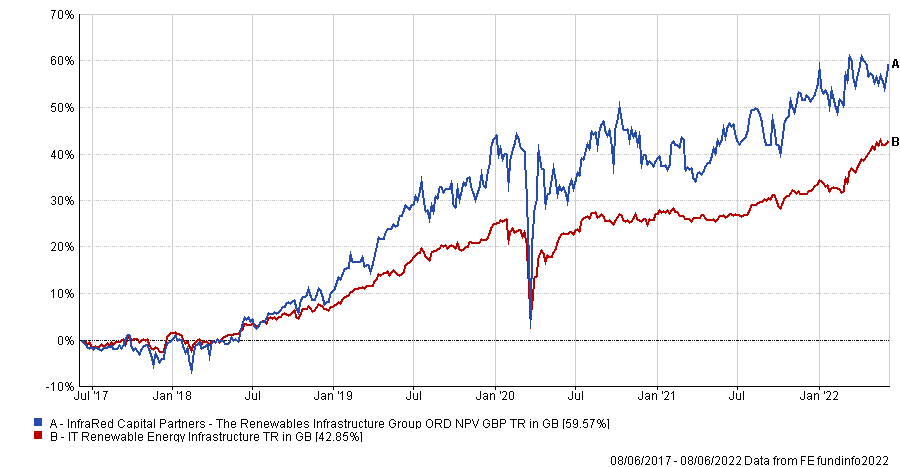

The Renewables Infrastructure Group Limited (TRIG)

Last up is TRIG, whose invests in companies and projects that produce clean electricity, contribute to European energy security and deliver shareholders long-term returns.

The London-listed trust is invested in a portfolio of wind, solar and battery storage projects spread across the UK, Ireland, France, Germany, Spain and Sweden.

“The clean energy generated by the portfolio in 2021 was capable of powering the equivalent of 1.7 million homes for a year”, said Clee.

Trust’s performance against sector over 5 years

Source: FE Analytics

Over five years, the company outperformed its IT Renewable Energy Infrastructure reference sector by 16.7 percentage points.

| Fund | Sector | Fund size | Fund managers (s) | Yield | OCF | Gearing | Premium/discount | Launch date |

| Impax Environmental Markets | IT Environmental | £1,310m | Bruce Jenkyn-Jones, Jon Forster | 0.7% | 0.85% | 1.6% | -4.6% | 22/02/2002 |

| The Renewables Infrastructure Group | IT Renewable Energy Infrastructure | £3,348m | InfraRed Capital Partners | 5.0% | 0.97% | 0.0% | 13.1% | 29/07/2013 |

| JLEN Environmental Assets Group | IT Renewable Energy Infrastructure | £722m | Chris Tanner, Chris Holmes | 5.6% | 1.24% | 0.0% | 5.8% | 31/03/2014 |