Hargreaves Lansdown has dropped the Aviva UK Listed Equity Income fund from its Wealth Shortlist following the announcement that FE fundinfo Alpha Manager Chris Murphy will be going on a temporary leave of absence.

The Wealth Shortlist is a selection of 74 funds that analysts at the firm have deemed to be best suited for investors wanting “well-balanced and diversified portfolios,” and Aviva UK Listed Equity Income’s place there was warranted due to their conviction in its managers Murphy and fellow FE fundinfo Alpha Manager James Balfour.

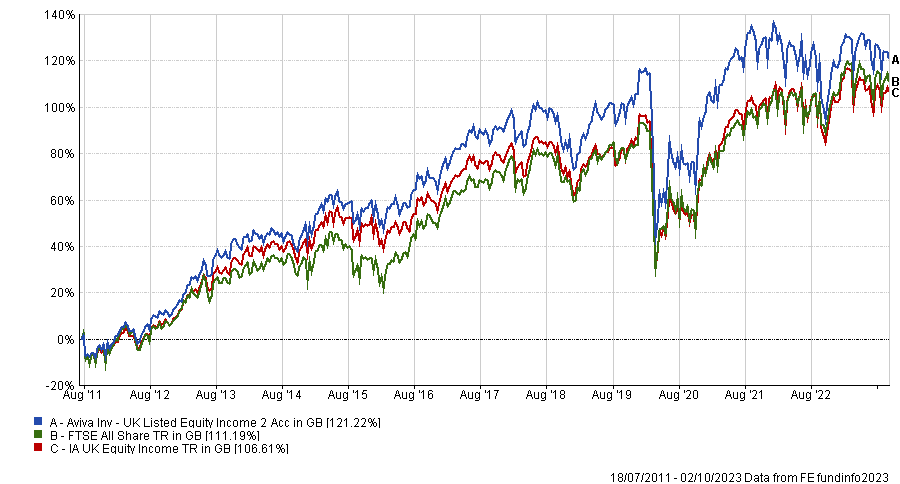

Murphy has run the fund since 2009, during which time the £874m portfolio made a total return of 121.2%, which was 14.6 percentage points better than its peers in the IA UK Equity Income sector.

Total return of fund vs benchmark and sector under Murphy’s management

Source: FE Analytics

His co-manager Balfour has been running the fund with him since 2016, but he is on paternity leave, putting the fund into the hands of replacement managers Trevor Green, who is head of UK equities and Charlotte Meyrick .

Joseph Hill, senior investment analyst at Hargreaves Lansdown, said: “Our conviction in the fund's long-term prospects largely lay with Murphy. Their absence reduces our conviction in the management of the fund below the level required for it to retain its place on the Wealth Shortlist.”

Although he noted that “Green has a long track record of managing UK equity funds” Hill said he is “not a manager we are familiar with, having spent recent years managing institutional mandates”.

Total return of fund vs benchmark and sector under Green’s management

Source: FE Analytics

Green has managed the Aviva UK Smaller Companies fund since 2014, with the £33m portfolio generating a total return of 52.4% under his leadership, trailing 5.8 percentage points behind the IA UK Smaller Companies sector average.